Monday, December 31, 2007

eClerx Services & Brigade Enterprises listing today...

Sunday, December 30, 2007

IT Education Stocks - Core Projects, Educomp & Everonn

The sector offers immense potential. Consider the following points:

- India's Poor literacy rate: 67% (as of 2004-05)

- The employable population is set to account for close to 65% of the total population over the next 10-15 years

- More than 40% of the students drop out by eighth standard. Read this pdf on a survey on Primary education & the level of drop outs in Maharashtra.

- The ever-expanding share of the services sector in the overall GDP. Fast-growing sectors such as finance & banking, IT & ITES, insurance, engineering, organized retailing, etc. require employees with some form of formal education.

Total spend by the GoI on the education sector is set to cross Rs.1.25 lac crore in fiscal 2008. IT is expected to account for anywhere between 7-10% of this spend, resulting in an opportunity worth Rs.8,750 - 12,500 crore.

To know more about this sector and its concerns & prospects, refer to the following links:

- IT Education Sector - Learning to Grow

- Annual Status of Education Report 2006 (Rural)

- IT education stocks in the limelight

- Dr.Ajay Shah's observations on the Education sector (elementary)

- Sarva Shiksha Abhiyan

- Find a detailed note on the IT Education Sector & Prospects in Core Projects' AR 0607

Friday, December 28, 2007

Monsanto India: Investment Update

Link 1:

In India, management believes its cotton trait product has the potential to be planted on 15 to 20 million acres by 2010.Worldwide demand for cotton is projected to grow by about 20 million bales or 16 percent in the coming decade, according to an analysis published by Texas Tech University's Cotton Economics Research Institute in May 2007. China will remain on top in production, and the United States will fall to number three. India will rise to the second spot on the heels of recent technological breakthroughs in seed and production practices, according to the forecast.

Link 2:

When Hugh Grant took the top job at Monsanto in May, 2003, the company's nickname in some quarters was "Mutanto." A growing chorus of critics warned that Monsanto's genetically modified plant seeds would wipe out the monarch butterfly, give people virulent new allergies, and reduce the planet's agricultural diversity. Author Jeremy Rifkin predicted that genetically modified organisms (GMOs) would turn out to be "the single greatest failure in the history of capitalism." Paul McCartney urged the world to "say no to GMO." Prince Charles wrote an editorial arguing that genetic engineering takes "mankind into realms that belong to God and to God alone." During the 12 months preceding Grant's elevation, Monsanto's stock price fell nearly 50% to $8 a share. In 2002, the prior fiscal year, the company lost $1.7 billion. "We were pretty financially fragile," recalls Grant, 49, who speaks with the lilt of his native Scotland. Fewer than five years later, Monsanto is thriving. The St. Louis company's net income leaped 44% last year, to $993 million, on $8.5 billion in revenue. Monsanto shares, which closed at $104.81 on Dec. 5, have risen more than 1,000% during Grant's tenure. At 58.6, the company's price-to-earnings ratio is about two points higher than Google's. These numbers reflect a broader story: that Monsanto has quietly turned the tide in the war over genetically modified foods.

Link 3:

Over the last decade, innovation for ag-operational companies has focused more on the input side and how a farmer can get more benefits through seeds, Casale said. The shift has transformed investment in agriculture by both seed and chemical companies," he said. Monsanto spends about 10% of its total sales, which are expected to hit $10 billion next year, on research and development. Syngenta and other major seed producers also have robust research and development budgets and a pipeline of seed and chemical products to show for it. A majority of the spending focuses on genetically modifying seeds in order to produce a higher yield, said analyst Bill Selesky of Argus Research. If one result of global climate change could be increased drought, then drought-resistant corn and other crops would certainly help mitigate this stress," Selesky said. Seeds also are being genetically modified to withstand pesticides, resulting in better crop yields."Today, farmers are getting more bang for their buck," Selesky said.

Transformers & Rectifiers listed today...

Read theIPOguru's listing strategy here.

Thursday, December 27, 2007

Thought Leader Forum by Legg Mason

- Michael Mauboussin (author of More Than You Know),

- Clayton M. Christensen (Innovator's Dilemma / Innovator's Solution...) , and

- Bill Miller.

Read the transcripts and listen to the webcasts of these speakers here.

Monday, December 24, 2007

Reliance Power Sector Fund, an interesting play

However, a closer look at the most recent fact sheet indicates some interesting developments. One, the scheme holds close to 32% of its assets in debt, derivatives, cash & other receivables, two, it holds very little of NTPC (the largest power generation company in India by miles) and nothing of Power Grid Corporation (the largest power distribution company in India, a monopoly at this point of time) and three, the scheme has mopped up close to Rs.2,380 crore in the last four months ended 30th November 2007.

I think the first point, i.e. holding close to 32% in debt, derivatives and cash is a clear indication of Reliance Capital getting significant allocations during the IPO of Reliance Power. And, given how most of the Reliance group (ADA or MDA) stocks have fared over the past few years, it won't be surprising if Reliance Power does well too, infact very well. This, despite the fact that Reliance Power might not earn great revenues till 2010-11. Well, if Reliance Petroleum can command a mcap of over a lac crore without refining a single drop of crude oil, then so can Reliance Power !!!

Point two is a little perplexing given that both, NTPC and Power Grid are light years ahead of their competition so to that extent any play of the power sector it incomplete without the two. And, it is quite ironical that NTPC, which is around 6 times bigger than Reliance Energy & Tata Power (in terms of sales) and around 8-10 times bigger (in terms of bottomline), is quoting at a P/E of 24 times whereas Reliance Energy and Tata Power are quoting at 33 times and 51 times respectively.

The third point (i.e. Reliance Power fund mopping up close to Rs.2,380 crore and most of it lying on the sidelines) indicates that their is still some more steam left in the power sector rally. Personally, I think most of the stocks in this sector are quoting at unheard of valuations. But, then history tells us that most of the bull markets end up in excesses.

Talking of power sector valuations, you may want to see these three charts that I had prepared a couple of weeks back. The charts provide a bird's eye view of the various segments of the power sector, their financial performance over the past three years and their current valuations. One sector that stands out is Power Cables. The sector has been growing at a rapid clip and is also attractively priced. Among the companies in this sector, I have taken a small exposure to Nicco Corporation.

Saturday, December 22, 2007

The case of Missing 'bathrobes' at Le Meridien

"This bathrobe has enjoyed considerable success among our guests, to the extent that some particularly enthusiastic customers have become "collectors of Le Meridien bathrobes". While we recognize that this initiative helps spread the reputation of our establishment, we nevertheless urge our most fervent supporters to make an effort to separate themselves from this admittedly endearing garment when they leave. (Alternately, a bathrobe may be obtained in exchange for a few rupees)."

This is one of the most awesome "even if sarcastic" messages I've come across. Good one, Le Meridien !

Friday, December 21, 2007

Power Sector, Is their any value left in this sector?

Tuesday, December 18, 2007

Jyothy Laboratories listing tomorrow...

theipoguru's listing strategy says:

Listing Call: Hold

Despite the current weakness in the market, we expect shares of Jyothi Laboratories to list at a healthy premium. At the upper end of the price band, the issue was priced in at a P/E of 21 times. Given that most of the FMCG companies are quoting P/Es of anywhere between 25-30 times, it will not be surprising if Jyothi Laboratories also lists at a similar multiple. With strong brand equity, wide distribution network, and well-distributed & tax-efficient production facilities, Jyothi Laboratories is a stock for the long haul.

The entire note can be accessed here.

Saturday, December 15, 2007

Monsanto India - Great Stock, Cheap Valuations.

Basic financials:

Sales (12M trailing) - Rs.338 crore

Net Profit (12M) - Rs.82.2 crore

3yr AVG RONW - 21%

P/E (TTM) - 16.6 times

Mcap - Rs.1,362 crore

Cash & Cash Equivalents (as of 31-Mar-07) - Rs.200 crore.

Approx Cash & CE (as of 30-Sep-07) - Rs.250 crore

Mcap_Net of Cash - Rs.1112 crore

P/E (net of Cash) - 13.5 times.

Listed peers Advanta and Kaveri Seeds are quoting at a P/E of over 25 times.

Investment Argument:

# BIG OPPORTUNITY - India is home to the world's largest tract of arable land, yet its farm's produce yields that are a fourth of the global average. This augurs well for companies offering agro-chemicals (especially herbicides) and hybrid seeds, which improve farm yields significantly.

# HIGHER DEMAND - Rising Consumption of Corn in India, thanks to increased consumption of western foods like Pizza, Sizzlers, and an increased usage of baby corn as a part of day-to-day cooking. Corn is also an important source of bio-diesel. Monsanto has a big winner in this category - 'Dekalb' (corn hybrid seeds). It is a global leader in corn seeds and has close to a 30% share in India.

# INCREASED AREA UNDER CULTIVATION - Higher crop prices, both in India and globally, and improving demand have resulted in a substantial shift from some of the other cash crops to corn. This year's Kharif crop pattern indicates this. Area under cultivation amounted to 74.6 lac hectares, as compared to the normal area of 62.2 lac hectares.

# STRONG PIPELINE - Monsanto India's parent company has a strong pipeline of new age hybrid seeds. R&D plays an important role in this industry with leaders such as Monsanto and Syngenta spending a significant amount of their revenues towards R&D.

# ROBUST RESERVOIR STATUS - Water levels in the 81 major reservoirs is healthy. They amounted to around 119% of the 10-yr average levels. Healthy water reservoir levels are an insurance against bad monsoons, and therefore render some predictability to the overall farming activity in India, which in turn determines the demand for farm inputs (such as herbicides and hybrid seeds, alongwith fertilizers).

At the current prices, the company can also be considered as a buy-back candidate. Infact, given that promoters hold close to 72.15% of the total equity, the cost of a buy-back will not be too high. Assuming, the company were to decide to undertake a buy-back, lets do some back of the envelope calculations -

Buyback price - Rs.3000 per share

Mcap at the aforesaid price - Rs. Rs.2,581 crore

Cost of the buy-back - Rs.718 crore (for a 27.8% share)

Current Cash & CE - Rs.250 crore

Actual cost of the buy-back - Rs.469 crore

Annual Cash Flow - Rs.92 crore

Pay-back period for the Company - 5.1 years. (Assuming 'NO' growth in cash flows, which is quite unlikely). Thus the pay-back period can be close to around 4-4.5 years.

Overall - At the current price, the Monsanto India scrip offers significant margin of safety with a healthy upside potential.

Points / Counter points ?????

Disclosure: Have a long position on this stock in the portfolios that I manage.

Tuesday, December 11, 2007

Nicco Corporation: Update (11-Dec-07)

A news release by Nicco Corporation to the BSE today stated this:

With reference to the earlier announcement dated July 30, 2007, relating to the signing of the term Sheet with Prysmian Cable Molding BV, Netherlands, Nicco Corporation Ltd (Nicco) has informed BSE that the Company has late last night entered into definitive agreements with Prysmian (Dutch) Holdings BV on the following basis:

1. Nicco and Prysmian (Dutch) Holdings BV belonging to the Prysmian group shall jointly participate in a new Company called Nicco Cables Ltd; where Prysmian (Dutch) Holdings BV shall become the majority shareholder (60%) with the Company holding 40%.

2. Prysmian Group is a world leader in the energy and telecommunications cables Industry with strong market position in higher-added value segments.

3. NICCO Cables Ltd, will acquire the Cable business from the Company pursuant to a Scheme of Arrangement and / or on slump sale basis, and shall be the Joint Venture Company. The common participation into the joint venture and the transfer of the business are subject to conditions precedent including approvals / consent of the Shareholders, lenders / CDR, Hon'ble High Court and other requisite parries / authorities as may be applicable.

- The Joint Venture will benefit from the combination of Prysmian's global knowledge and technology expertise and Nicco's business network and knowledge of local market and will be also well positioned to exploit the strong growth trends in Indian Cable market driven by substantial investments in infrastructure.

4. The main features of the contractual arrangement in relation to the Joint Venture Company are as under:

a) The Board of the Joint Venture Company shall consist of five Directors, three of them including the Managing Director to be appointed by Prysmian and two of them, including the Chairman, to be appointed by Nicco, Mr. Rajive Kaul, Chairman of Nicco shall be the Chairman of the JV Company. Prysmian will be responsible for managing the Joint Venture's operations.

b) Nicco shall receive a consideration in excess of Rs 130 crores, (subject to adjustments), for the transfer of its cables division. The transaction will also result in, inter-alia, the debt relating to the cables business getting transferred from the Company to the Joint Venture Company.

c) Nicco Corporation and Prysmian (Dutch) Holdings BV have agreed upon customary shareholder rights including board representation rights, quorum rights, affirmative rights, information rights, anti-dilution rights, share transfer restrictions such as a right of first offer, call / put option and other governance mechanisms including a deadlock resolution mechanism.

--

what does this mean:

- Nicco Corpn will hive off its cable biz and the debt attached to it

- Nicco Corpn will receive an additional Rs.130 crore for this stake sale

- Investors will therefore (probably) receive shares in Nicco Cables (the new entity) and will continue to hold some stake in Nicco Corpn.

- The question now is, what will the new Nicco Corpn (minus its cable biz) do?????

- And, what will the management do with Rs.130 crore that the company will receive from Prysmiam???

I had written on this stock a couple of days ago.

Monday, December 03, 2007

NICCO Corporation: engineering / real estate play or wat?

12M trailing sales - Rs.423 crore

12M trailing PBDIT - Rs.42 crore

Current Mcap - Rs.317 crore (at a CMP of Rs.35)

The company has two divisions - cables and project engineering. However, the cable division (that includes both telecom cables and power cables) accounts for close to 80% of the total sales. With both the telecom and the power sectors doing very well, demand for Nicco's wares is firmly in place. However, owing to operational and financial troubles, the company's networth almost turned negative in recent years.

Things seem to be improving according to this. The company's financial performance seems to be improving too.

Sonata Investments' (Anil Ambani-Rel. Energy group co.) stake in this company is around 14.75%. The investment arm of the ADAG group is known to have made some smart investments in the past, e.g. TV Today, SAREGAMA, and a host of other media companies. So what could have interested the ADAG group to pick up a stake in this troubled company ?? As of now, I have no idea about the same.

However, there are some other interesting developments taking place at this counter -

------------------------------------------------------------------------------------------------

Milan 31st July 2007. Prysmian Cables & Systems, a worldwide leading player in the cable industry, has signed a Term Sheet with Indian Nicco Corporation to become the majority shareholder of a new joint venture company that will encompass all Nicco Corporation's cable activities. The Board of Directors of Prysmian today approved in principle the entrance into the Term Sheet. The deal, subject to the finalization of a definitive agreement and further approval/consent of Nicco's corporate debt lenders and relevant local authorities, is expected to close during the first half of 2008. Nicco Corporation will remain as a minority shareholder of the new Joint Venture Company.

With net sales of 55.2 million Euro in Fiscal Year 2006-2007 Nicco Corporation's cable division has 2 manufacturing operations, 6 branch offices located in the country's most important urban areas and approximately 900 employees. Nicco Corporation's cable division is active in the production of a wide range of medium voltage and low voltage power cables and industrial cables for applications in several sectors (OEMs, Windmill, Infrastructure, Mining, Raylways, Defence, etc.).

------------------------------------------------------------------------------------------------Now the question is, if the cables division will be hived off, what will Nicco Corporation do? Only Project Engineering? Whether the new cables company (in JV with Prysmian) will be a listed company? The management has provided no clarity on this.

Another interesting (both positive and negative) bits on the company include:

- Land & building on free hold basis - Rs.80 crore (on cost-basis) [any development possibility here]

- 25% Holding in Nicco Parks (mcap - Rs.41 crore, Nicco Corp's stake value - Rs.10 crore). Reports have it that Nicco Parks owns 40 acres of prime land in Kolkata (something I still need to confirm), which is valued at close to Rs.2000 crore, valuing Nicco Corp's stake in the company to Rs.500 crore (vis-a-vis its current mcap of Rs.317 crore).

- Steady decline in promoter's stake in the company, down from 17.4% to 16.9% (during Mar - Sep '07).

Conclusion: Something seems to be cooking up on this counter. What, is the question?

Disclosure: I own shares of Nicco Corp, bought at Rs.24 per share. The stock is fraught with high risk (thanks to the uncertainties mentioned above) and therefore forms a very small portion of my portfolio.

Saturday, December 01, 2007

Back to Blogging & a New Investment Plan in Action

Growth stocks - Stocks that are currently under-researched or are still evolving but offer great promise in the long run. The two key factors here are - scalability of business (growth potential) and the management (growth engine).

Value Stocks - These are mis-priced stocks available at significant discount to their 'current' fair value. The key factors to look here are - P/E, P/B, [ lower the better] and Return ratios (RONW or ROCE) [higher the better]. Some of the investments in this category may include stocks that are currently undergoing some kind of a restructuring, which is likely to yield results at a later date.

The ratio 60:40, in favour of growth stocks, will primarily work in this way - profits out of value investments will be pumped into growth stocks, given that most of the growth investments take time to mature.

Further, instead of investing in lumps, I've started investing in a more systematic manner. The rule is 10% of my monthly basic salary is put into stocks.

I hope my new and fine-tuned (or so I think) investment plan works fine, it has done so far in the past few months, but then 3-4 months is too short a period to gauge any performance.

So here we go...

Friday, August 17, 2007

No More Blogging, atleast not for sometime.

Tuesday, August 07, 2007

Link: Chicken-and-egg economics by Caroline Baum

Aug. 6 (Bloomberg) -- If companies keep hiring, the economy will hang in there just fine.

There's something counterintuitive about that proposition, and repeating it often enough (it's one of economists' favorite palliatives) doesn't make it true. I mean, businesses don't hire out of the goodness of their heart or to earn humanitarian awards. Quite simply, they hire people to produce the goods and services consumers want to buy, hopefully turning a profit in the process.

Companies would prefer to do it all with machines, which don't get paid holidays, a lunch hour or sick days (well, maybe some mechanical downtime now and then). Industrial equipment doesn't need health insurance, complain about the boss or file sexual harassment suits.

Most businesses, however, can't function without humans, at least not yet. So they hire the minimum number of workers they need to earn the maximum possible profit. It may be crass, but that's how it works.

So what to say when you read comments that distort the natural order of things?

For example, following news on July 27 that the U.S. economy expanded at a real 3.4 percent rate in the second quarter, up from 0.6 percent in the first, an economist told the Wall Street Journal that ``the real risk for consumer spending is if for some reason companies slam on the brakes and stop hiring.''

In other words, if businesses just keep adding to their payrolls, the consumer will keep on spending his wages. The catalyst in this model is business hiring.

Cluck, Cluck....

--

Saturday, August 04, 2007

Man Industries: robust Jun'07 numbers

> Sales were up by 54% to Rs.321 crore

> PBDIT was up 60% to Rs.38 crore

> PAT shot up by 66% to Rs.17.4 crore

The company reported an EPS (on full dilution basis) of Rs.6.5.

For the full year though, it is expected to report an EPS in the range of Rs.25-30 per share.

At a CMP of Rs.267, the company is trading at a price-to-earnings multiple of less than 10 times. It remains a BUY in my books and I continue to hold it. Though, I do trade in and out of it occasionally.

Thursday, August 02, 2007

George Soros' Quantum fund turns big seller in Indian Stock Markets

Quantum Fund's transactions that were reported on the BSE today were:

> Ansal Infra 1,391,912 shares @ 267 = Rs.37 crore

> Apollo Hospital 762,551 shares @ 488 = Rs.37.2 crore

> Aurobindo Pharma 2,211,710 shares @ 636 = Rs.141 crore

> GVK Power 2,254,150 shares @ 532 = Rs.120 crore

> Shriram Transport 3,200,000 shares @ 160 = Rs.51.2 crore

> TOTAL = Rs.386 crore (close to USD 100 million).

Wednesday, August 01, 2007

Learn about Monetary Policy, India-specific and in-general....

His recent opinion on the 'credit policy statement' by RBI Governor - Y.V.Reddy can be accessed here.

Saturday, July 28, 2007

Links: US equities continue declining, Marc Faber....

> Marc Faber's view on the drop in equities in the US and on sub-prime woes.

> Asian markets feel the tremors of a decline in the US. Read here.

> Map detailing the break-up / flow of the residential mortgage market in the US.

> Turmoil in the markets by the Economist.

Friday, July 27, 2007

Sea of Red on Stock Markets across the globe

Almost a no-brainer that the Indian equity juggernaut will receive a jolt today. Equity markets in India held on nicely in the last two days. That, I think was primarily because of yesterday's expiry on the F&O market. As the top traded options were primarily put options they had to expire worthless and they did. Read my previous blog entry on this.

Almost a no-brainer that the Indian equity juggernaut will receive a jolt today. Equity markets in India held on nicely in the last two days. That, I think was primarily because of yesterday's expiry on the F&O market. As the top traded options were primarily put options they had to expire worthless and they did. Read my previous blog entry on this.But with the new expiry beginning today, markets are quite vulnerable to global shocks....and today is likely to one of those days. Hang on to your seats as we see volatility take centre stage over the next few sessions.

Thursday, July 26, 2007

Where will Nifty end on expiry, can we guage from the Options market?

The first question that we need to ask is: Who are the sellers in the Options market?

I don't think its the retail investor. I think most of the option sellers are the supposedly smart investors. If that is the case, then it makes an interesting reading of the Options market, a day before the expiry.

Lets then try to build a hypothesis, based on the above:

1. Most of the Options on the F&O market expire worthless

2. Most of the Options are written by smart investors

3. Thus, we can say that Smart Investors write most of the options, which also happen to expire worthless

4. We know that every trade has a buyer and a seller. Thus, options with highest volumes are also the ones which have maximum Smart Investor interest, since they are the ones who write most options.

5. Since Smart Investor interest is the highest in top traded options, they must be on the sell-side, since it is highly unlikely for retail investors to sell options, in any case, and that too on the penultimate day.

6. Thus, top traded options on the penultimate day reflect Smart Investor's outlook for the market, the following day.

The top traded options on 25-July-07 (for July expiry) were:

1. CE 4600 (SP) - 36,802 contracts

2. PE 4600 (SP) - 29,542

3. PE 4500 (SP) - 16164

4. PE 4550 (SP) - 13023

5. CE 4300 (SP) - 11669

Put contract dominate Call contracts by a margin of around 10,000 contracts. If looked at more closely, between the SP range of 4,500-4,600, there are close to one lac contracts traded with close to 60k on the put side. Thus, it is quite likely that most of these contract will expire worthless, i.e. Nifty will end above 4,600. Infact, almost all these contracts will expire worthless if the Nifty closes exactly at 4,600 today.....we will see that in about 15 hrs from now....

contradictions / contributions, as always are most welcome !!

Tuesday, July 24, 2007

Readings: Bill Gross and Gavekal

> Investment Outlook by the bond king - Bill Gross of Pimco.

Saturday, July 21, 2007

JK Lakshmi Cements: Robust Jun'07 numbers...

> Sales growth (volume) - 18%

> Production growth - 16%

> Sales growth (value) - 43%

> Operating profit - 47%

> Profit after tax - 77%

> EPS - 57%

> 12M trailing EPS - 36.7

> At a price of Rs.151, the stock trades at a P/E of a mere 4.1 times, one of the lowest among its other listed peers.

The company's results in the next few quarters are expected to be equally robust, given firm prices and higher volume growth (on the back of capacity expansions that were completed by the end of the Mar'07 qtr). The Sep'07 quarter is likely to be particularly good. This is because Sep'06 was a poor quarter for the company, owing to heavy rains which affected both production and despatches.

Thus, with a low base, the Sep'07 numbers are expected to look phenomenal. More important will be the expansion in the 12M trailing EPS, which now stands at Rs.36.7 per share. I expect that to go up to around Rs.42 to a share. At that kind of an EPS, the scrip will trade at an EPS of around 3.5 times. Ridiculous levels to be trading at, I think.

I have written about this company twice in the past. You can read it here and here.

Wednesday, July 18, 2007

Buy Saw Pipe companies says Religare Securities....

> Man Industries, Target Price - 364, CMP - 287, Upside - 27%

> Jindal Saw, TP - 995, CMP - 684, Upside - 41%

> Maharashtra Seamless, TP - 778, CMP - 657, Upside - 18%

> PSL, TP - 436, CMP - 384, Upside - 14%

I wrote about Man Industries recently. You can read it here.

Monday, July 16, 2007

Why did Subros rise today?

Now, the news/announcement that followed a little later in the day was that of -

> a Board meeting to consider Stock Split and the Final Dividend for the year.

This hardly sounds like a reason to cheer the stock up by around 10%. Don't think the run-up is sustainable. Had the delivery percentage been higher, there would have been a hope for the rise to sustain itself.....but with a 27% delivery it doesn't look like it...will be watching the counter closely over the next few days.

Had written about this stock a few weeks ago, read it here.

News (17/7/7): To invest Rs.200 crore to double its capacity to 1.5 million units by 2012.

Saturday, July 14, 2007

Bullish on Cement - DB. Take a look at JK Lakshmi

The DB report is bullish on major cement companies like ACC, GACL, Grasim, India Cements, Ultratech Cement, and Shree Cement and has put out price targets that 20-39 per cent above the current levels.

I had invested in a company called - JK Lakshmi Cement back in March at around Rs.120 per share. The stock has since moved to Rs.132, a modest gain of 10%. However, I think there is a lot of steam left in this stock.

It is among the cheapest cement stocks with a price-to-earnings ratio of less than five times. It reported an EPS of Rs.32 per share for the year ended Mar'07. One of the plausible reasons why this company is trading at such ridiculously cheap levels could be its high leverage. I think it has Debt-to-equity ratio of over 2.5 times. Nevertheless, consider the following positives:

> the company recently expanded its capacity, thus growth in profits to not only come from higher prices but also from higher volumes

> the company is setting up a captive power plant, 36MW, which will pull down power costs that account for a third of cement companies operational costs...and maybe more in some cases..

Now, the DB report values the much larger and leaner cement companies at a P/E of around 14 times, discounting their FY09 earnings.

Even if JK Lakshmi Cements were to be valued at half that rate, ie. at 7 times. The target price of the scrip would be around Rs.210, a good 60% above its CMP of Rs.132. That on the basis of its current 12-month trailing EPS.

If the same is assumed to grow at around 30% over the next two years, which the DB report does given its price outlook, the EPS at the end of FY09 could be close to Rs.50 per share. A multiple of 7 times on the FY09 EPS would take the price target to Rs.350 per share, compared to its CMP of Rs.132.

Counter points / Contradictions ??

Friday, July 13, 2007

Inflation (WPI) up marginally at 4.27%....

Read a detailed note on today's inflation numbers from CMIE here.

When will I learn - "When to Sell Stocks"..???

this has happend to me quite a few times in the past....more often than not i've ended up selling far too early.......a few examples -

> opto circuits - bought @ 150, sold out @ 250 (cum-bonus)

> indiainfoline - bought @ 87, sold out @ a marginal profit...dont remember the price...

> Union bank of india - bought @ IPO price, sold out at Rs.80 odd......

.....and a few more!!!

When Will I Learn, When to Sell ???????????

Pipe Gains....finally!!!!....(Man Industries)

Indian companies are fast gaining criticial size in this business, led by Jindal Saw, Welspun Gujarat, PSL and Man Industries. Each of these companies are sitting on order-books which twice the size of their current annual sales, rendering high visibility over the next 2-3 years. they are today where capital goods and construction companies were an year back......

Tuesday, June 19, 2007

ICICI Bank FPO: To invest or not?

You can see the comparative valuations table here and a detailed review note here. (both by Mr.Ashok Kumar).

Update (20-Jun-07): You can see the subscription details of this FPO here.

Day I - Retail investors bid for a mere 2.1 lakh shares on the first day of the FPO, out of the available 3.2 crore shares!!!

Day II - The count has improved a little to around a 1.2 million shares, though still light years away from the quota of 3.2 crore shares...??? How many think that the retail portion will get fully subscribed????

Day IV - The FPO finally closed on Friday. Along expected lines, the issue got heavily subscribed on the QIB side, but surprisingly managed to scrape through the retail portion too....now lets wait and watch....whether the stock cracks in the trading sessions to follow....my feel is, it will drop hereon.

Saturday, June 16, 2007

More readings: The Crash of the US economy has begun..

The Economist on the recent bond prices crash in the US..

Friday, June 15, 2007

Education of a Speculator by Victor Niederhoffer (Great book)

Monday, June 11, 2007

Mega Issue Opens today - DLF

Investors are advised not to invest in this issue. The reasons are well-explained by:

1).Sucheta Dalal - here.

2).Ashok Kumar - here.

Btwn, Enam Securities too came out with a report on the Real Estate sector and has rated "DLF" as an underperformer with a price target of less than Rs.420, i.e. a good 15-20% below the issue price.

Update: Rakesh Jhunjhunwala in an interview with CNBC had this to say about the DLF IPO:

Q: Have you invested in the real estate sector at all?

A: I don't have any investments in real estate.

Q: How is that possible, last one-one and half years they have been some of the biggest multi-baggers? You must have had reasons to look at those opportunities and let them pass?

A: It's a very dicey subject. None of the real estate companies pay tax. I don't know how they get their profits. Second thing I also feel that anything, which can be valued as one plus one is equal to eleven; is not what ultimately gives you returns in markets. I don't know, I have never been into real estate bull in my life and wrongly so.

Q: But you have bought a lot of real estate yourself; how come you don't buy those stocks?

A: I have not bought any real estate. I bought a house and office.

Q: Commercial real estate you have dabbled in the past, haven't you?

A: Not at all. That's not my cup of tea.

Q: So you would not be queuing to buy DLF, would you?

A: No I wouldn't.

Q: Why - valuations or innate distrust of the business?

A: I would say valuations, more than anything else.

Q: So you have had a look at it?

A: Yes.

Q: You don't agree with those - slight premium to land bank - those kinds of valuation models at all?

A: Why should I go and buy DLF, I will buy the land only.

Sunday, June 10, 2007

Readings - Carl Icahn, the shrewdest investors

Investing in IPOs in India is a FREE LUNCH....

Some brief numbers:

No. of IPOs: 100

Coverage period: late 2005 - 2007 till date.

Returns computation: Avg Price on the listing day over Issue price.

Avg. Price defined as Average (Open + High + Low + Close).

Result:

IPOs with +ve first listing day (i.e. avg. price > issue price) - 73

IPOs with +ve opening (i.e.open price > issue price) - 78

Average Gain to an investor who sells on the Ist of listing : 24.3%

I think it is this free lunch that has caused so much trouble in the IPO market. The IPO scam that was unearthed by the SEBI last year. The scam in brief was this:

"It involved manipulation of the primary market—read initial public offers (IPOs)—by financiers and market players by using fictitious or benaami demat accounts. While investigating the Yes Bank scam, Sebi found that certain entities had illegally obtained IPO shares reserved for retail applicants through thousands of benaami demat accounts. They then transferred the shares to financiers, who sold on the first day of listing, making windfall gains from the price difference between the IPO price and the listing price."

Any investment that earns returns (above the risk-free rate) without any risk will attract infinite investors. However, since the supply of IPO stock is limited, and there are limitations to how much one can apply, there is a mad rush to invest in IPOs.

Friday, June 08, 2007

De-listing candidates: D-Link India

Mcap: Rs.226 crore

Non-promoters holding: 36.6%

Value of Non-prom. hldg: Rs.83 crore

Cash & Cash Equivalents for the year ended Mar'06: Rs.51.5 crore

Npat (12 mnths ended Mar'07): Rs.22 crore

Dividend paid out: Rs.6 crore

Retained Earnings for 06-07: Rs.16 crore

Cash & CE at the end of Mar'07 (approx): Rs.67.5 crore

Cost of a mgmt buyback -

@ 25% premium to the CMP - Rs.104 crore

@ 50% premium to the CMP - Rs.125 crore

@ 100% premium to the CMP - Rs.167 crore

Adjusting for the Cash & Cash Equivalents in the B/S:

@ 25% premium - Rs.36.6 crore

@ 50% premium - Rs.57.4 crore

@ 100% premium - Rs.98.9 crore

Based of last five years Cash Profits (Rs.28 crore), how much time will it take for the company earn the amount spent on the buy-back (net of the C&CE):

@ 25% premium - (36.6 / 28) = 1.3 years

@ 50% premium - (186 / 74) = 2.0 years

@ 100% premium - (320 / 74) = 3.5 years

A DEEP VALUE STOCK WITH GROWTH POTENTIAL....

D-Link India has been bearing the brunt of falling realisations in case of products like motherboards. It's margins have shrunk substantially over the past 3 yrs. However, the worst seems to be over for the company and over the next few years, growth in sales and profits will be driven by broadband and networking related products. Its only a matter of time before the CPE segment hits big in India.....the broadband sector in India is ripe for a growth seen in the telecom sector. What can be the potential size of this market:

Well here are some numbers to ponder:

1).One modem (cable or DSL) approximately costs Rs.1500-2000.

2).So if we hit 20 million broadband connections in the next few years with say 50% using DSL or Cable Modems, we are looking at 10 million modems and thats around Rs.1500 crore.

3).Even if the co. captures 20% of this, its looking at Rs.300 crore (same as its full year's turnover in FY07).

4). And as the number of broadband connections grow....so will D-Link's topline and therefore its stock price too!!

Monday, June 04, 2007

De-listing candidates - Abbott Labs

Mcap - Rs.703 crore

Non-promoter holding: 34.86%

Value of Non-promoters holding - Rs.245 crore

Cash & Cash Equivalents as of the latest financial year - Rs.218 crore

Avg. Npat over the last five years - Rs.69 crore

Avg. Depcn over a similar period - Rs.5 crore

Avg. Cash Flow (a rough estimate) - Rs.74 crore per annum

Cost of a buyback -

@ 25% premium to the CMP - Rs.306 crore

@ 50% premium to the CMP - Rs.367 crore

@ 100% premium to the CMP - Rs.490 crore

Adjusting for the Cash & Cash Equivalents in the B/S:

@ 25% premium - Rs.88 crore

@ 50% premium - Rs.150 crore

@ 100% premium - Rs.272 crore

Based of last five years Cash Profits, how much time will it take for the company earn the amount spent on the buy-back (net of the C&CE):

@ 25% premium - (88 / 74) = 1.2 years

@ 50% premium - (150 / 74) = 2.0 years

@ 100% premium - (272 / 74) = 3.7 years

This ratio sounds more like our usual P/E ratio, and it actually is...in terms of the price the company will pay to acquire the remaining stake and time it will take to earn it back. The reason I am strongly in favour of a buy-back is the [USE OF CASH & CASH EQUIVALENTS]. There are neither being used for business purposes, since their current business barely requires any major CAPEX and nor is the mountain of cash being deployed for other purposes such as a OTS special dividend, acquisition, etc.

If the co. can't find any good reason for deploy its cash, it might as well give it back to the shareholders, instead of sitting on it for years. It only does one thing, destroys shareholder wealth, and plenty of it!!

A rising pile of cash, invested essentially in conservative mutual fund schemes (debt & liquid) can at best earn returns of 8-10% or in an exceptional case, a little more. Compare the same with the company's Return on Equity of over 35%!!

The stock remains a strong de-listing candidate despite repeated (1 & 2) buy-back offers from the Company.

Sunday, June 03, 2007

L2 exams finally happened in India....

Thursday, May 10, 2007

Friday, April 27, 2007

Trade Loans - Prosper.com

Got the link from Daily Speculations.

Wednesday, April 25, 2007

How serious is this buyback offer? - GTL !

GTL Ltd has informed BSE that the Board of Directors of the Company at its meeting held on April 25, 2007, inter alia, has recommended following:

1. Buyback of Company's shares at Rs 300 per share.

2. Set aside an amount of Rs 275 crores for the buyback.

3. The buyback is subject to the approval of shareholders and regulatory authorities.

However there are the few questions that come to one's mind -

1). How serious is this offer given that the current market price is only Rs.185, a good 40% below the offer price?

2). If the company wished, it could have simply bought back shares from the open market, I think SEBI allows companies to buyback 5% of their equity from the secondary market in a year without triggering the open offer.

3). If at all the buyback offer is serious, why did the share price did not witness a substantial increase today?

4). In fact, the scrip witnessed huge volumes today, six times more than the daily average over the last 2 weeks and more importantly witnessed heavy supply at higher levels which resulted in the share price falling down from a high of around Rs.193 to close at Rs.185.

GTL has a poor track-record and was reported to be one of the Ketan Parekh's favorite stocks in 2000-01. After the crash it had witnessed close to 98% price erosion....from a high of Rs.3,500 it fell to as a low as Rs.65-70 per share. And, I think this release on the BSE is completely non-serious. The company is not likely to buy 9.1 million shares @ Rs.300...and spend Rs.275 crore...when it can easily buy the same from the market at less than Rs.200 crore.

Investors looking to invest into this company should tread caution....

Warren Buffet and the 2-20 Crowd !

Here's an excerpt:

Who am I to question the Great One? He’s produced 21% CAGR for 40 years and I don’t even use my real name when I write blog postings. But I have to push back a little on Buffett’s entertaining, but somewhat misleading salt-of-the-earth populism. It certainly sells tickets at the Qwest centre, but it’s an unhelpful contribution to the important debate over investment management fees.

In fairness, Buffett is one of then world’s most successful producers of alpha - beating the S&P500 by an average of 10%p.a. over the past 4 decades. But he takes his usual swipe at the “2-and-20 crowd” in his recently released 2006 investment letter. We commend his implicit emphasis on alpha as the raison d’etre for fees, but he is too quick to assume hedge funds simply deliver beta......

Read the entire article here.Monday, April 23, 2007

Yuan continues to appreciate v/s USD....

1). "China's textile industry says it loses 8.2 billion yuan ($1.1 billion) of annual profit for each percentage point rise in the currency"

2). "The textiles sector, with average gross profits of five to 10 percent will cease to be as lucrative once the yuan appreciates by 5 percent"

3). Growth in China's textile industry slows

Does this bode well for Indian textile companies? Maybe, especially if the sharp appreciation in Yuan forces Chinese companies to raise prices. However, one important thing that can nullify the above is a continuation in the appreciation of the rupee vis-a-vis the dollar, as seen in the last one month or so.

Watch the currency movements closely over the next few months as also the export numbers, both from India and China to the US.

Textile scrips have been big underperformers on the bourses over the past one year. Scrips like Arvind Mills, Alok Industries, Gokaldas Exports, House of Pearl Fashions, etc. all are down by anything between 15-50 per cent. With prices at their 52-week lows and valuations looking down the barrel, it wont be a bad idea to invest into some of these. A Contrarion Call.

Saturday, April 21, 2007

Research house recommendations? Crack'em!

Petronet LNG - Long-Term Moderate Outperform.

Wonder how many of their clients wud have understood what is to be done with Petronet LNG, given the kind of recommendation??? You either say - BUY/HOLD/SELL. What on this earth does LONG-TERM-MODERATE-OUTPERFORM mean??

FG usually offers ratings from the list of following recommendations (which in itself is quite a long list of recommendations):

Positive ratings

- Buy

- Buy at Declines

- Outperform

Neutral ratings

- Hold

- Marketperform

Negative ratings

- Sell

- Sell into strength

- Underperform

- Avoid

Long-Term-Moderate-Outperform........is a new addition to the list. All the best FG clients.

Thursday, April 19, 2007

Subros: A Value pick.

Sunday, April 08, 2007

Control Raj making a strong comeback?? (First commodities, industrial goods and now cricket)

1). Raw jute futures

2). Export of Pulses

3). Sugar exports

4). Futures trading in Tur & Urad

5). Futures trading in Wheat and Rice

6). Freeze on Cement prices

There is also a [pending] list:

1). Futures trading in Maize

2). Natural rubber futures

3). The Big One - Ban on futures trading in all commodities

Well, if we thought that control-raj is restricted to agro-commodities and industries goods, think again! The Board of Control for Cricket in India recently released a few guidelines, primarily to save its face following the humiliating defeat of the Indian cricket team at this year's Cricket World Cup. Some of the guidelines, which are similar in nature to the above cases are:

1). No. of endorsements per player restricted to THREE

2). No brand can hire more than two cricketers

3). Players to take prior permission from the Cricket Board before signing endorsement deals

What the BCCI aims to do by this is really questionable?

Because, the problem of non-performance in no way can lie with endorsement deals. Cricketers who get a lot of endorsement deals are the ones who are seen as good players or who have performed well in recent times. So really speaking if a player aint playing well, will the sponsor still continue paying top dollars to the underperformer? I think not. Its simple advertising economics. And to top it all, if the Cricket selection committee were to think that a player is not giving his best and is instead concentrating more on sponsorship deals, then they can simply DROP HIM from the next series. Once dropped, a player holds not much of a brand value for the sponsor. Earnings from sponsorship deals will automatically drop and the pressure to perform will mount.

But ofcourse, the BCCI needs to be seen to be doing something....and thats precisely what it is doing, much like some of the Ministeries at the Centre.

CONTROL RAJ coming back with all the expected (read: Anti-Market Economy) effects!

Wednesday, March 28, 2007

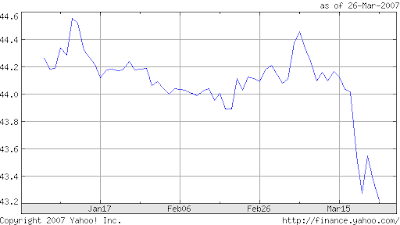

INR kissed 42.8 to a USD today...watch out IT stocks!

What is happening to the rupee?

An appreciation of close to two per cent in a span of five working days....and around double that in over a months time!

Has RBI stopped buying dollars from the open market, because the inflows are not as strong to result in a four per cent appreciation in the rupee against the greenback?

Ofcourse, the sharp appreciation in the rupee against the dollar will keep foriegn investors happy since besides the gain from appreciation in stock prices, FIIs also gain from an appreciation in Rupee. This is because for the same amount of rupees, currently invested, they stand to earn more dollars.

However, Indian IT companies wont like this sharp appreciation in rupee. Since they are exporters of services and earn their revenues in dollars, they will get less rupees for the same number of dollars compared to a month ago. Their margins will take a hit if the rupee appreciation continues.

here's a small and a very simplistic example:

- Company: Infy

- Size of order executed: USD 100 million

- Order finalised in say Feb: when the conversion rate was Rs.44.5 to a Dollar.

- Infy accordingly submits its quote, gets the order and executes the same.

- It stands to earn a 20% margin, ie. USD 20 million or if converted into INR (@ 44.5), Rs.89 crore.

- Suppose INR to a Dollar appreciates to Rs.42.8 (as is the case now). For its USD 20 million, Infy will now recieve (20,000,000 x 42.8) = Rs.85.6 crore or a loss of Rs.3.4 crore.

Watch out for a weakness in IT counters on the bourses. Infact, its not just the IT companies, but also garment exporters (Gokaldas, for eg)., and pharma companies.....

Tuesday, March 27, 2007

Another cool offering from GOOGLE...real-time flight information!

Flying High with Google SMS

Monday, March 26, 2007 at 7:58:00 PM

Posted by Deepak Sethi, Software Engineer, Mobile Team

Ever spent 15 minutes on the phone shouting answers at the automated airline attendant while rushing to the airport? How cool would it be to get real-time flight info just by sending a quick text message? Well, now you can using Google SMS.

Simply text your flight number to 466453 (‘GOOGLE’ on most mobile devices), and the status information will be sent back to you. Or text a specific airline name, and Google will send back the main phone number to call.

This is available for flights departing or arriving in the U.S., and all of the information is provided by flightstats.com. And as always, it’s free.

Give it a try, and then let us know what you think.

--

Found it from google's official blog. Given the timeliness (or the lack of it) of low-cost airlines in India, this service will surely be a run-away hit in India.....

The War on Inflation...Business World article

1 April 2007: After a huge rally by oilseed farmers protesting against the maximum price, the government announced a minimum price to be paid to farmers for oilseeds, which will be higher than the maximum price paid by consumers. The difference will be recovered through an oilseeds cess to be paid by oil companies.

15 April: With WPI inflation going through the roof, thanks to a big jump in the price of eggs and fish, the government today imposed price controls on eggs and fish. "It's aimed at buying support from the fish-eating Goa population before the assembly elections there," said a cynical opposition member.

1 May: Milk producers have complained that they were forced to charge higher prices because of the high cost of milch cattle. The commerce minister has imposed a price ceiling on cows. Meanwhile, the plea by oil companies that they have nothing to do with oilseeds has been rejected.

1 June: WPI inflation numbers have jumped this week on account of a sharp rise in the price of gingelly oil (up 12 per cent), copra (up 9 per cent), zinc ingots (17 per cent), fluorite (48 per cent), fire clay (29 per cent), steatite (20 per cent), magnesite (13 per cent), felspar (4 per cent), kaolin (3 per cent) and capsules other than vitamins and antibiotics. The government has promptly announced price controls on all these items.

15 June: Egg producers have complained to the finance minister about the high cost of hens, which they claimed was the major reason for the rise in egg prices. A decree has since been signed by the finance minister imposing a price ceiling on hens.

30 June: Copra producers have argued for a level playing field. Conceding to the force of their argument, the Prime Minister today issued an order that no coconut in the country should sell for more than Rs 6.75 each.

1 July: The PM today amended his order on coconuts and announced that large ones (measuring more than 4 inches in diameter) may now be sold at a higher price of Rs 7.25 each.

15 July: With eggs, fish, felspar, kaolin and coconuts being sold in the black market, the government has threatened severe action. The Enforcement Directorate has been told to crack down on money laundering by fishermen. "Every rotten egg trader should be hanged from the nearest lamp post," thundered the home minister.

1 September: The dates for the Gujarat state elections have been announced. In other news, the government has imposed price controls on dhokla, thepla and khakra.

15 September: The ceiling on zinc prices has led to zinc producers shutting shop, as a result of which zinc users have to use high priced imports. To counter this anti-social behaviour, the government today announced that each zinc producer must produce a minimum of 10,000 tonnes of zinc or face immediate execution.

1 October: Stung by criticism that the government has done nothing to stem the rise in prices of services, price ceilings have been imposed on dance bars.

15 October: Gearing up for the 2009 Parliamentary elections, the finance ministry today released Volume 1 of the Price and Production Control Handbook (932 pages) containing detailed lists of items under price ceilings and production quotas. Volumes 2 and 3 will be out soon. "We are proud that we have been able to bring out this document in the 90th year of the founding of the Soviet Union," gushed the finance minister, whose designation will soon be changed to Comrade Chief Price Controller. In other news, the Republic of India today changed its official name to 'The Union of Indian Socialist Republics' (UISR).

The article is available here.