The Securities Exchange Board of India, on 27 Apr 2006, unearthed a big scam in the primary market. The regulator came down heavily on the intermediaries (such as Karvy, Indiabulls, among others) for their alleged involvement in the fraud.

In an interim order released last evening the SEBI said -

In the recent past while examining off-market transactions in the IPOs of Yes Bank Ltd. (‘YBL’) and Infrastructure Development Finance Company Limited (‘IDFC’), it came to the notice of SEBI that certain entities had cornered IPO shares reserved for retail applicants by making applications in the retail category through the medium of thousands of beneficiary accounts in the name of fictitious/benami entities with each of the application being of small value so as to be eligible for allotment under retail category. After the allotment, these fictitious/ benami allottees transferred these shares to their principals who in turn transferred the shares to their financiers. Most of these shares were sold immediately on listing.

The entire order can be downloaded from here.

SEBI pulled up some of the best known banks in the country, namely - HDFC Bank, IDBI Bank and ING Vyasa Bank. These banks are also banned from opening fresh demat accounts. So much for the clean image that these banks carry on their shoulders !!

However, I think the bigger problem is not these entities (ie. either pple like roopalben, karvy or the aforesaid banks), but the whole system of quotas (for eg. 25% for retail participants, 50% for institutional investors, etc.) in IPO allotment. I think there is great incentive for pple to apply for shares in IPO via multiple accounts (fictitious or otherwise). Even my 15-yr old cousin could comprehend the way out for non-allotment of shares during IPOs - put more applications. Multiple applications simply increase the probability of individuals getting some shares during the allotment process.

Possible solution (or is it ?)

What if we revamped our IPO process to something like what Google did last year, ie. can companies simply auction their shares without having to resort to any of the intermediaries and without having these quotas. They can be allowed to set a minimum price, but let mkt forces decide the final IPO price (instead of the weird book-building process with a tight price band).

Once the price is decided by the investors bidding for shares of a company, the allocation should be done on a pro-rata basis across-the-board. Further, large investors (QIBs or Institutional) be required to put up application monies upfront. Currently they are exempted from this. This system can (or rather I think it does) attract frivolous applications that can be used to artificially show higher demand. To summarise -

1.Shift the IPO process from a quota-based one to a pure auction process

2. Make allocations on a pro-rata basis

3. Let the market decide the final issue price, instead of the co. providing a small band (5-10%) which is really a mockery of the book-buliding and the price discovery process.

4. Make sure all entities pay application monies upfront, so as to avoid frivolous applications.

Friday, April 28, 2006

Saturday, April 22, 2006

Mutual funds sitting on mountains of cash

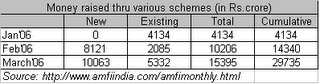

Equity mutual fund schemes in India raised a whopping Rs.29,735 crore during January-March 2006. This includes money raised by new schemes as well as exisiting ones. This is one of the highest ever quarterly collection by the mutual fund industry. Does this mark the end of the current bull-run ? I do not know.

However, a look at the tables above indicate that mutual funds are still sitting on mountains of cash (to the extent of Rs.25,000 crore). Given that SEBI does not allow MFs to sit on cash for long, MFs are likely to make more investments (and much larger in size) over the next two months.

MFs are only a part of the overall equation. The other major player is the FII. They have been net sellers in April. Infact, between 10-20 April, they were net sellers to the tune of USD 700 million (Rs.3000 odd crore). Will FII continue to be net sellers is again something I do not really know. But, given the response to Reliance Petroleum's initial public offering, one can conclude that the current trend of net sales by FIIs is most likely a temporary one.

Moral of the story - Stay Invested in equities, atleast for now !!

However, a look at the tables above indicate that mutual funds are still sitting on mountains of cash (to the extent of Rs.25,000 crore). Given that SEBI does not allow MFs to sit on cash for long, MFs are likely to make more investments (and much larger in size) over the next two months.

MFs are only a part of the overall equation. The other major player is the FII. They have been net sellers in April. Infact, between 10-20 April, they were net sellers to the tune of USD 700 million (Rs.3000 odd crore). Will FII continue to be net sellers is again something I do not really know. But, given the response to Reliance Petroleum's initial public offering, one can conclude that the current trend of net sales by FIIs is most likely a temporary one.

Moral of the story - Stay Invested in equities, atleast for now !!

Wednesday, April 19, 2006

Have you been taking tips from message boards ?

With stock markets booming, all kinds of investors have been flocking to the dalal street these days (not in the real sense though). One of the things that have mushroomed over the past few years are the "message boards" on various personal finance cum market news sites.

A "message board" is an internet forum for holding discussions, allowing people to post messages and comment on other messages. Not just this, websites these days offer forums dedicated to topics. Famous among these topics is -- stocks and stock markets. Hundreds and thousands of some smart and some not so smart investors/speculators/traders are actively participating in these.

While participating and holding discussions is ok. What one needs to worry about is whether the common man is taking investing decisions based on the stock ideas/tips/hot stocks posted on these forums. Most of the discussions taking place on these internet forums can be used to cheat investors since there is a big question mark over the identity of the person on the other side of the forum.

A 15 year old kid was caught doing a similar act in the US in 2000. He was later on fined by the SEC for over USD 200,000. Here is an excerpt of a news article on the same -

On Sept. 20, 2000, the SEC settled its case against a 15-year-old high-school student named Jonathan Lebed. The S.E.C.'s news release explained that Jonathan -- the first minor ever to face proceedings for stock-market fraud -- had used the Internet to promote stocks from his bedroom in the northern New Jersey suburb of Cedar Grove. Armed only with accounts at A.O.L. and E*Trade, the kid had bought stock and then, "using multiple fictitious names," posted hundreds of messages on Yahoo Finance message boards recommending that stock to others.

He had done this 11 times between September 1999 and February 2000, the S.E.C. said, each time triggering chaos in the stock market. The average daily trading volume of the small companies he dealt in was about 60,000 shares; on the days he posted his messages, volume soared to more than a million shares. More to the point, he had made money. Between September 1999 and February 2000, his smallest one-day gain was $12,000. His biggest was $74,000. Now the kid had agreed to hand over his illicit gains, plus interest, which came to $285,000.

Ranjit thanks for pointing me to this article.

A "message board" is an internet forum for holding discussions, allowing people to post messages and comment on other messages. Not just this, websites these days offer forums dedicated to topics. Famous among these topics is -- stocks and stock markets. Hundreds and thousands of some smart and some not so smart investors/speculators/traders are actively participating in these.

While participating and holding discussions is ok. What one needs to worry about is whether the common man is taking investing decisions based on the stock ideas/tips/hot stocks posted on these forums. Most of the discussions taking place on these internet forums can be used to cheat investors since there is a big question mark over the identity of the person on the other side of the forum.

A 15 year old kid was caught doing a similar act in the US in 2000. He was later on fined by the SEC for over USD 200,000. Here is an excerpt of a news article on the same -

On Sept. 20, 2000, the SEC settled its case against a 15-year-old high-school student named Jonathan Lebed. The S.E.C.'s news release explained that Jonathan -- the first minor ever to face proceedings for stock-market fraud -- had used the Internet to promote stocks from his bedroom in the northern New Jersey suburb of Cedar Grove. Armed only with accounts at A.O.L. and E*Trade, the kid had bought stock and then, "using multiple fictitious names," posted hundreds of messages on Yahoo Finance message boards recommending that stock to others.

He had done this 11 times between September 1999 and February 2000, the S.E.C. said, each time triggering chaos in the stock market. The average daily trading volume of the small companies he dealt in was about 60,000 shares; on the days he posted his messages, volume soared to more than a million shares. More to the point, he had made money. Between September 1999 and February 2000, his smallest one-day gain was $12,000. His biggest was $74,000. Now the kid had agreed to hand over his illicit gains, plus interest, which came to $285,000.

Ranjit thanks for pointing me to this article.

Saturday, April 15, 2006

New addition to the blog - ppt on p/e ratio and buying RCVL shares

I've added a new section to this blog - Useful stuff to download. Over a period of time I will be adding things I find useful as a stock market student. To begin with i've added a small presentation on the price-to-earnings ratio (or p/e ratio).

Btw, markets corrected sharply last week, falling by over 600 points from the highs of the week. It is no surprise that FIIs led the decline. They not only sold shares worth over Rs.1000 crore in the cash market but went short in the derivatives market by over Rs.5,000-6,000 crore. I think this a bull market correction, that is painful, but is likely to be short in nature. I think FIIs will soon turn out positive figures. Furthermore, domestic mutual funds are sitting on mountains of cash, raised in the last two months ended March 2006. See here and here.

So if the correction continues during the next week, I for one will be looking to add a few stocks to my portfolio.

One of the stocks that I recently purchased is Reliance Communication Ventures (RCVL). The company seems undervalued at current levels given that it has some 18 million mobile subscribers and is yet quoting less than half of Bharti Televentures value (of over Rs.70,000 crore).

Here are how the numbers stack up -

Points to think -

Conclusion - RCVL offers good upside with little risk on the downside.

Btw, markets corrected sharply last week, falling by over 600 points from the highs of the week. It is no surprise that FIIs led the decline. They not only sold shares worth over Rs.1000 crore in the cash market but went short in the derivatives market by over Rs.5,000-6,000 crore. I think this a bull market correction, that is painful, but is likely to be short in nature. I think FIIs will soon turn out positive figures. Furthermore, domestic mutual funds are sitting on mountains of cash, raised in the last two months ended March 2006. See here and here.

So if the correction continues during the next week, I for one will be looking to add a few stocks to my portfolio.

One of the stocks that I recently purchased is Reliance Communication Ventures (RCVL). The company seems undervalued at current levels given that it has some 18 million mobile subscribers and is yet quoting less than half of Bharti Televentures value (of over Rs.70,000 crore).

Here are how the numbers stack up -

- Mobile subscribers: RCVL and BTVL - 18 million each

- ARPU: RCVL -Rs.412 per month, BTVL - Rs.470 per month

- Avg. minutes per user: RCVL - 547 mins, BTVL - 411 mins

- Mcap (as of 13 Apr '06): RCVL - Rs.33k crore, BTVL - Rs.71k crore

Points to think -

- Each of the two companies is adding around a million customers every month

- Given current rate, the two will have over 30 million customers by the end of current fiscal and some 38-40 million by FY08.

- Given the current ARPUs, expected revenues from just the mobile business are likely to be around Rs.20,000 crore. Adding another Rs.5-7,000 crore (a conservative estimate) from RCVL and BTVL's other businesses (such as broadband, landline, ILD, etc.), total revenues are expected to be around Rs.25,000-27,000 crore.

- PAT margin of 20% (which is what BTVL currently earns and I expect RCVL would earn the by end of this fiscal) would yield a NPAT of Rs.5000-5400 crore. A discouting of 15 times for a fast growing business such as telecom should result in these companies attracting valuations of close to Rs.75-80,000 crore.

- BTVL (Rs.71,000 crore) is currently trading close to this, whereas RCVL is trading at a significant discount (at Rs.33,000 crore).

Conclusion - RCVL offers good upside with little risk on the downside.

Tuesday, April 11, 2006

Stock markets are booming and so is the art of stock picking/investing ?

I hear a lot of pple talking about investing in stocks these days. People who never bothered or are least informed about companies are talking like pro's. A few examples -

Just the other day an office colleague of mine was talking confidently about the hottest IPO in town - Reliance Petroleum. While the company is offering its shares at Rs.62 per share, my friend here claims that it will touch Rs.300 per share on the day of its listing. Well what exactly does a price of Rs.300 per share mean for this company.....read on.

Reliance Petroleum is raising funds to "set up" a world scale petroleum refinery in the state of Gujarat. At Rs.62 per share, it is valued at around Rs.28,000 crore, that for a company which is still to lay the foundation for its refinery, let alone earning any revenues. And if at Rs.62 per share it is valued at Rs.28,000 crore, Rs.300 per share would fetch it a value of a mindnumbing Rs.135,000 crore. This is higher than its parent co. Reliance Industries. Well, so much for a booming stock market and its effect on investor psyche. Beware, speed breakers ahead !!

In another incident a colleague was happy to share his investment made this week in a new mutual fund scheme. This after he stayed away from the markets for all this while thinking it was risky to invest his savings (read hard earned money) into stock markets. While it is nice to know that here was a retail investor who is taking a safer route of investing into stock markets through a mutual fund (and a reputed one at that)....but what one needs to wonder is whether - is this the right time to make fresh investments ? May be or maybe not.

Students of behavioral finance would say that such incidents mark the beginning of an end !

Btw, listed below are a few investing rulez that my friend (Tariq) and I follow. We've learnt these over the last 2-21/2 years of stocks investing experience. Hope you find'em useful in these markets -

1. MORE JEWS (or MARWARI's in India's case) LOST THEIR SHIRTS on the WALL STREET AVERAGING in a falling market than those affected by the Great Depression.

NEVER AVERAGE.

2. Always buy stocks that offer a good MARGIN OF SAFETY.

Margin of safety is the difference between the intrinsic value of a stock (i.e. value based on stock valuation and what the company is actually worth) and the price that the market sets on a stock (i.e. stock price is a matter of market participants' opinions and is different from the intrinsic value). Buying stocks with healthy MoS provides a higher probability of earning returns.

3. It is inseparable from Human Nature; To Hope and To Fear. The successful trader/investor/speculator has to fight these two deep-seated instincts. Instead of hoping he must fear; instead of fearing he must hope. He must hope that his loss may develop into a much bigger loss; and hope that his profit may become a big profit.

IT IS ABSLOUTELY WRONG TO GAMBLE IN STOCKS THE WAY THE AVERAGE MAN DOES !

4. What does a man do when he sets out to make the stock market pay for a sudden need ?

He not only just hopes. He gambles. To begin with, he is after an immediate profit. He cannot afford to wait. Which means, he foolishly begins to believe that - THE MARKET MUST BE NICE TO HIM AT ONCE, IF AT ALL.

NEVER GO TO STOCK MARKETS 'HOPING' YOU WILL MAKE MONEY, YOU ARE BETTER OFF BETTING ON HORSES THAT WAY.

The last two quotes are from the book - Reminiscences of a Stock Operator by Edwin Lefevre. It is a biography on the greatest stock trader of our lifetime - Jesse Livermore. It is a must read for anyone looking to invest in stocks.

Just the other day an office colleague of mine was talking confidently about the hottest IPO in town - Reliance Petroleum. While the company is offering its shares at Rs.62 per share, my friend here claims that it will touch Rs.300 per share on the day of its listing. Well what exactly does a price of Rs.300 per share mean for this company.....read on.

Reliance Petroleum is raising funds to "set up" a world scale petroleum refinery in the state of Gujarat. At Rs.62 per share, it is valued at around Rs.28,000 crore, that for a company which is still to lay the foundation for its refinery, let alone earning any revenues. And if at Rs.62 per share it is valued at Rs.28,000 crore, Rs.300 per share would fetch it a value of a mindnumbing Rs.135,000 crore. This is higher than its parent co. Reliance Industries. Well, so much for a booming stock market and its effect on investor psyche. Beware, speed breakers ahead !!

In another incident a colleague was happy to share his investment made this week in a new mutual fund scheme. This after he stayed away from the markets for all this while thinking it was risky to invest his savings (read hard earned money) into stock markets. While it is nice to know that here was a retail investor who is taking a safer route of investing into stock markets through a mutual fund (and a reputed one at that)....but what one needs to wonder is whether - is this the right time to make fresh investments ? May be or maybe not.

Students of behavioral finance would say that such incidents mark the beginning of an end !

Btw, listed below are a few investing rulez that my friend (Tariq) and I follow. We've learnt these over the last 2-21/2 years of stocks investing experience. Hope you find'em useful in these markets -

1. MORE JEWS (or MARWARI's in India's case) LOST THEIR SHIRTS on the WALL STREET AVERAGING in a falling market than those affected by the Great Depression.

NEVER AVERAGE.

2. Always buy stocks that offer a good MARGIN OF SAFETY.

Margin of safety is the difference between the intrinsic value of a stock (i.e. value based on stock valuation and what the company is actually worth) and the price that the market sets on a stock (i.e. stock price is a matter of market participants' opinions and is different from the intrinsic value). Buying stocks with healthy MoS provides a higher probability of earning returns.

3. It is inseparable from Human Nature; To Hope and To Fear. The successful trader/investor/speculator has to fight these two deep-seated instincts. Instead of hoping he must fear; instead of fearing he must hope. He must hope that his loss may develop into a much bigger loss; and hope that his profit may become a big profit.

IT IS ABSLOUTELY WRONG TO GAMBLE IN STOCKS THE WAY THE AVERAGE MAN DOES !

4. What does a man do when he sets out to make the stock market pay for a sudden need ?

He not only just hopes. He gambles. To begin with, he is after an immediate profit. He cannot afford to wait. Which means, he foolishly begins to believe that - THE MARKET MUST BE NICE TO HIM AT ONCE, IF AT ALL.

NEVER GO TO STOCK MARKETS 'HOPING' YOU WILL MAKE MONEY, YOU ARE BETTER OFF BETTING ON HORSES THAT WAY.

The last two quotes are from the book - Reminiscences of a Stock Operator by Edwin Lefevre. It is a biography on the greatest stock trader of our lifetime - Jesse Livermore. It is a must read for anyone looking to invest in stocks.

Saturday, April 01, 2006

Holding companies, interesting investment plays

Investment in holding companies makes for an interesting play. It offers some great arbitrage opportunities. Here is how - holding companies are usually pure investment vehicles that hold shares in either the group's flagship company, or investments in a host of other listed/non-listed group companies. An article in Outlook money explains this well. Here's a excerpt from the article:

A holding company can be a pure shell company with investments in one asset block or in many. For instance, Vardhman Spinning, the holding company of Mahavir Spinning, has no manufacturing business of its own; it owns 10.2 million shares in Mahavir Spinning. Then there’s UB Holdings, which transferred its beer business to a subsidiary, United Breweries, and now holds 48 per cent equity stake in McDowell’s, and 100 per cent in Kingfisher Airlines and UB City. A similar story is seen in KojamFinvest, the holding company for the Nicholas Piramal group.

In India, such holding companies are valueed at deep discount to their real market value. The discount is as high as 65-70 per cent. But, if one were to monitor the twins (ie. the market value of the holding company vis-a-vis the market value of its holdings) there can be a case for an arbitrage play.

The arbitrage should, however, be done with the assumption that the "upper limit" for the holding company is around 30-35 per cent of the mkt value of the underlying holdings. Thus, any deviation from this on the lower side can be used as an opportunity. I've listed down example of two such cases in which i've been trading in the last one year, with reasonably good success.

Case 1 - Morarka Finance.

The company is a holding company of Dwarikesh Sugar Industries Ltd (DSIL). It holds 2,348,818 shares or a 15.1 per cent stake in DSIL. At current prices (Rs.257 as on 31-Mar-06), DSIL is valued at Rs.400 crore. Value of Morarka Finance' holding in DSIL thus comes to around Rs.60 crore (15% of Rs.400 crore). Given that holding companies in India are valued at 30-35 per cent of their true market value, Morarka Finance should be valued at Rs.18-20 crore. But, at Rs.30.5 per share, Morarka Finance's mcap is only Rs.13.5 crore. Morarka Finance shares therefore seem to be undervalued to the extent of 33-48 per cent.

Disclosure: I've an open position in Morarka Finance (bought day before yesterday @ Rs.30.5). I intend to sell it once the arbitrage is no longer available. ie, when, - 0.3 * Value of Morarka Finance' holding = Mcap of Morarka Finance.

Case 2: SRF Polymers.

SRF Polymers is a holding company of SRF Ltd. The company holds 36.5% stake in SRF directly and through its 100% subsidiary - SRF Polymer Investments Pvt. Ltd. At Rs.331 per share, market capitalisation of SRF Ltd. comes to Rs.2,142 crore. Value of SRF Polymers holding thus comes to around Rs.781 crore. Thus, the approximate the market value of SRF Polymers should be in the range of Rs.234-274 crore (30-35% of true market value). But, at current prices (Rs.214), SRF polymer shares are quoting at a mcap of Rs.140 crore. Clearly, there seems to be an upside of 67-92 per cent from current levels.

Disclosure: I do not hold any shares in SRF Polymers. I tried buying them in the last two trading sessions, but unfortunately the damn thing was stuck at the 5% upper circuit. Hope to get in on Monday.

There are many such other companies listed on the bourses. However, I've restricted myself to these two. Some of the other companies include - Zuari Industries, Vindhya Telelinks, UB Holdings, Nahar group companies, Winsome Textiles Industries, Shree Rajasthan Syntex and Shree Rajasthan Texchem, etc. Investors are advised to do a thorough study before taking any investment calls made out on this or for that matter any other blog.

In India, such holding companies are valueed at deep discount to their real market value. The discount is as high as 65-70 per cent. But, if one were to monitor the twins (ie. the market value of the holding company vis-a-vis the market value of its holdings) there can be a case for an arbitrage play.

The arbitrage should, however, be done with the assumption that the "upper limit" for the holding company is around 30-35 per cent of the mkt value of the underlying holdings. Thus, any deviation from this on the lower side can be used as an opportunity. I've listed down example of two such cases in which i've been trading in the last one year, with reasonably good success.

Case 1 - Morarka Finance.

The company is a holding company of Dwarikesh Sugar Industries Ltd (DSIL). It holds 2,348,818 shares or a 15.1 per cent stake in DSIL. At current prices (Rs.257 as on 31-Mar-06), DSIL is valued at Rs.400 crore. Value of Morarka Finance' holding in DSIL thus comes to around Rs.60 crore (15% of Rs.400 crore). Given that holding companies in India are valued at 30-35 per cent of their true market value, Morarka Finance should be valued at Rs.18-20 crore. But, at Rs.30.5 per share, Morarka Finance's mcap is only Rs.13.5 crore. Morarka Finance shares therefore seem to be undervalued to the extent of 33-48 per cent.

Disclosure: I've an open position in Morarka Finance (bought day before yesterday @ Rs.30.5). I intend to sell it once the arbitrage is no longer available. ie, when, - 0.3 * Value of Morarka Finance' holding = Mcap of Morarka Finance.

Case 2: SRF Polymers.

SRF Polymers is a holding company of SRF Ltd. The company holds 36.5% stake in SRF directly and through its 100% subsidiary - SRF Polymer Investments Pvt. Ltd. At Rs.331 per share, market capitalisation of SRF Ltd. comes to Rs.2,142 crore. Value of SRF Polymers holding thus comes to around Rs.781 crore. Thus, the approximate the market value of SRF Polymers should be in the range of Rs.234-274 crore (30-35% of true market value). But, at current prices (Rs.214), SRF polymer shares are quoting at a mcap of Rs.140 crore. Clearly, there seems to be an upside of 67-92 per cent from current levels.

Disclosure: I do not hold any shares in SRF Polymers. I tried buying them in the last two trading sessions, but unfortunately the damn thing was stuck at the 5% upper circuit. Hope to get in on Monday.

There are many such other companies listed on the bourses. However, I've restricted myself to these two. Some of the other companies include - Zuari Industries, Vindhya Telelinks, UB Holdings, Nahar group companies, Winsome Textiles Industries, Shree Rajasthan Syntex and Shree Rajasthan Texchem, etc. Investors are advised to do a thorough study before taking any investment calls made out on this or for that matter any other blog.

~

Any contrary views on this style of investing ?

Happy investing.

Subscribe to:

Posts (Atom)