Wednesday, January 30, 2008

"What if's" for today's US Fed meeting?

The trouble is that even if the fed funds rate is cut by 50 basis points, what do stock market participants do - given that the same has already been factored in...

looks like being in cash and taking some of the profits off the table on days of sharp bounce-backs or the so-called relief rallies (provided they are there for the taking, which is most likely to be the case with people who have been in the markets for over a year now)

A few more things may have also changed in the past few weeks -

- new found respect for words like "risk & return"

- sharp drop in investor expectations

- importance of asset allocation, etc.

Saturday, January 26, 2008

Readings: Benjamin Franklin' 13 virtues....

| 1. TEMPERANCE. | Eat not to dullness; drink not to elevation. |

| 2. SILENCE. | Speak not but what may benefit others or yourself; avoid trifling conversation. |

| 3. ORDER. | Let all your things have their places; let each part of your business have its time. |

| 4. RESOLUTION. | Resolve to perform what you ought; perform without fail what you resolve. |

| 5. FRUGALITY. | Make no expense but to do good to others or yourself; i.e., waste nothing. |

| 6. INDUSTRY. | Lose no time; be always employ'd in something useful; cut off all unnecessary actions. |

| 7. SINCERITY. | Use no hurtful deceit; think innocently and justly, and, if you speak, speak accordingly. |

| 8. JUSTICE. | Wrong none by doing injuries, or omitting the benefits that are your duty. |

| 9. MODERATION. | Avoid extreams; forbear resenting injuries so much as you think they deserve. |

| 10. CLEANLINESS. | Tolerate no uncleanliness in body, cloaths, or habitation. |

| 11.TRANQUILLITY. | Be not disturbed at trifles, or at accidents common or unavoidable. |

| 12. CHASTITY. | Rarely use venery but for health or offspring, never to dulness, weakness, or the injury of your own or another's peace or reputation. |

| 13. HUMILITY. | Imitate Jesus and Socrates. |

Wednesday, January 23, 2008

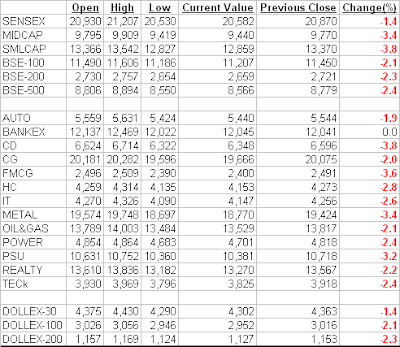

Indian stock markets collapse; take global cues

BSE Sensex: -17.6%

BSE Midcap: -27.5%

BSE Smallcap: -26.7%

Most retail portfolios (cash folios) are down by anywhere between 25-40%. F&O traders that were long would have lost their shirts though.

Who did what during this period:

| Cum. MF | Cum. FIIs | Sensex | ||

| 1-Jan-08 | 183.5 | 142.3 | ||

| 2-Jan-08 | 478.7 | -102.2 | 0.8% | |

| 3-Jan-08 | 968.7 | 622.9 | -0.6% | |

| 4-Jan-08 | 1585.3 | 1131.7 | 1.7% | |

| 7-Jan-08 | 1615.3 | 1050.8 | 0.6% | |

| 8-Jan-08 | 1627.8 | 2104.2 | 0.3% | |

| 9-Jan-08 | 1426.6 | 2378.8 | 0.0% | |

| 10-Jan-08 | 1472.9 | 1748.0 | -1.4% | |

| 11-Jan-08 | 1198.7 | 1861.7 | 1.2% | |

| 14-Jan-08 | 647.3 | 2036.1 | -0.5% | |

| 15-Jan-08 | 127.8 | 2261.9 | -2.3% | |

| 16-Jan-08 | 68.3 | -17.7 | -1.9% | |

| 17-Jan-08 | 529.2 | -2203.7 | -0.8% | |

| 18-Jan-08 | 258.0 | -3559.8 | -3.5% | |

| 21-Jan-08 | 2256.2 | -5985.5 | -7.4% | |

| 22-Jan-08 | 5034.9 | -10250.7 | -5.0% |

Clearly, global market cues and a concurrent pull out by FIIs have had a big impact on the markets. So far they have pulled out more than 2.5 billion dollars, that too in five straight trading sessions. However, a pull out of a mere USD 2.5 billion dollars is really small when one considers the overall inflows and the total market cap of Indian markets.

Where to now?

US Federal Reserve in an extreme step reduced the overnight federal funds rate by a sharp 75 basis points, to 3.25%. This has had a positive impact on most emerging markets with Brazil and Mexico recording over 5% gains overnight. Some of the major Asian markets open in the green too. Each of the three major indices - Nikkei, Hang Seng and Shanghai are currently up by anywhere between 2-5%.

Indian markets are therefore expected to open in positive territory this morning. However, will the gains sustain over the next few days? Maybe not. Given the kind of drop we've seen in the past few days, a lot of people would be looking to exit on rallies, simply to balance our their positions which are currently tottering deep in the red.

theIPOguru has a nice and apt article on "Greed and Fear". Here's the article ...

It was flattering to receive all those calls and SMS’s yesterday and again, this morning, after the stock-market did the ‘Humpty-Dumpty’ act.

Most of those of you who called had seen my article titled ‘A Sense of Déjà vu’ which appeared in the HT ( Delhi and Mumbai edition ) and was also posted on the blog.

Call it premonition, or simply the wisdom that comes with hair turning grey over the years spent at the bourses, but at the end of the day, that’s what I have believed investing is all about. Its all about Asset Allocation, Re-Balancing and lots of Common Sense.

Fundamentals cannot be ignored . As good old Abe Lincoln once said ‘ You can fool all the people, some of the time; Some of the People, all the time; But you can never fool all the people, all the time’.

Will the markets rebound after this hammering ? They certainly will. When ? Ask the FIIs ( or should it be the world’s richest brothers ? ).

Like I mentioned, fundamentals cannot be ignored forever.

So my friends, keep the faith, consider buying at successive declines and play the waiting game. The rewards will come.

Patience, like I often mention, is a great virtue.

--

Here's the link to the entire article.

As for me, I've been buying (with whatever little money I have...) some of the stocks that I'm bullish on:

- Crest Animation

- Monsanto India

- Dish TV

- Patel Integrated Logistics

Sunday, January 20, 2008

Readings: What does Goldman Sachs know, that we don't?

A brief excerpt of the article is as follows:

Jan. 17 (Bloomberg) -- In retrospect, the most intriguing subplot in the collapse of the subprime mortgage market has been not the size of the losses but their distribution. Wall Street firms have a talent for getting themselves into trouble together. They all were long Internet stocks when Internet stocks collapsed and they'll all be long North Korean credit-default swaps whenever North Korea gets hot and then crashes.

What's odd about the subprime crash is Goldman Sachs Group Inc. A single firm took a position contrary to the rest of Wall Street. Giant Wall Street firms are designed for many things, but not, typically, to express highly idiosyncratic views in the market. Even more surprising is how little Wall Street seems to have dwelled on how and why Goldman Sachs made its killing.

----- link to the entire article.

Wednesday, January 16, 2008

Corn prices shoot up; Bullish on Monsanto India

Corn prices shoot through the roof

Bloomberg has an article on the recent spurt in the international prices of corn (commonly known as maize in

"Jan. 14 (Bloomberg) -- Corn rose to the highest ever in

World inventories of corn will fall to the lowest since 1984 on Sept. 30, the U.S. Department of Agriculture said Jan. 11. Inventories in the

Corn futures for March delivery rose 17 cents, or 3.4 percent, to $5.12 a bushel on the Chicago Board of Trade. The price earlier jumped the exchange's 20-cent limit to $5.15, topping the record for a most-active contract of $5.135 reached in May 1996. The highest price for any contract was $5.545 for July futures in 1996.

Corn rallied 17 percent last year after surging a record 81 percent in 2006, on increased demand to produce ethanol and feed livestock and poultry."

What is driving up international corn prices?

The USDA estimated world corn output in the 2007-2008 season, which began Oct. 1, at 766.7 million metric tons, down from 769.3 million forecast in December. That compares with an estimated 703.9 million tons harvested last season. Global consumption will rise to 772.7 million tons, up from the 766.4 million forecast last month and 721.7 million consumed last year, the department said. This will turn things dramatically, i.e. from a surplus of around 48 million tonnes to a deficit of 6 million tonnes.

Factors driving up international corn prices are:

- Passage of the New Energy Bill that requires that around 25% of total energy consumption in the

- higher demand from feed livestock & poultry

Impact on domestic corn prices?

As has been the case in most of the other commodities (agri or non-agri), a sharp increase in international prices have pushed up domestic prices too. Corn is no exception to this. Corn prices have moved up by over 50% in the past few months. They are currently quoting at around Rs.900 per quintal, compared to around Rs.500-600 per quintal a few months ago.

Higher domestic corn prices mean?

Higher corn prices have improved realizations dramatically for the farmers. As a result, more farmers are sowing corn today than at any point in the past. This has resulted in a substantial shift in the sowing pattern, from some of the other cash crops to corn. The area under cultivation this year amounted to a 74.6 lac hectares, compared to the normal area of 62.2 lac hectares. This is a substantial jump in the agriculture sector.

Those directly affected (i.e. the poultry sector which is the largest consumer of corn in

What does this mean for Monsanto

Higher area under cultivation will result in a significant jump in demand for hybrid corn seeds, of which Monsanto is a clear leader. The company’s ‘Dekalb’ brand of corn seeds is a market leader and overall Monsanto has close to 30% share (which is expanding with every passing year). This should result in a healthy topline and an even better bottomline expansion.

Rally in corn prices augurs well for companies like Monsanto, which supply the seed for sowing. Monsanto is the largest supplier of corn seeds in the

--

Disclosure: I have an open position in Monsanto in the portfolios that I manage.

I’ve written about this stock a few times in the past. You can read about it – first, second and third.

Tuesday, January 15, 2008

Future Capital Holdings - New Issue

The full article can be accessed here.

Is Anant Raj Industries taking over Nicco Corporation??

However, recently, I came across some very interesting bits of information in the bulks deals data released by the stock exchanges. One of the large investors Niraj Realtors (stake: 14.75%) has been continuously selling in the open market and the buyer on the other side has been a rather unknown company by the name of Rapid Estates Private Ltd. Infact, the latter has now cornered more than 5% stake in Nicco Corporation.

While one might be wondering as to why is Niraj Realtors selling....I am more keen to know who is Rapid Estates Private Ltd.

Now, according to this link (dated: 4-Dec-06), Rapid Estates Private Ltd. is a subsidiary of Anant Raj Industries, one of the fastest growing companies on Dalal Street in recent years, from being a rather unknown tile company to becoming a full-fledged real estate company with a mcap of close to Rs.9,000 crore.

The question :

1). Are the two companies (i.e. the one that has acquired more than 5% stake in Nicco Corporation and the one that is Anant Raj Industries' subsidiary) same??

2). If yes, why is Anant Raj Industries cornering a stake in Nicco Corpn?

The answer could be this:

- Nicco Corporation hives off cable business to Prysmian Cables for Rs.130 crore

- It then hives / divests its engineering business into a separate company or to some other company

- what will be left is a holding company with plenty of cash and lot of land (at book value) in Kolkata

- Anant Raj Industries may possibly take a strategic stake in the company and form a JV to develop that real estate.

Counterpoints???

Sunday, January 13, 2008

Readings: Do Capital Controls Work? by ILa Patnaik

ILa Patnaik has an insightful article on Capital Flows in India. The article appeared in the Indian Express on 8th Jan, 2008.

---

India has witnessed a capital surge in recent months. Even though there was a reversal of reforms on several fronts with the re-introduction of capital controls, there was a $17.4 billion increase in net capital flows in the Jul-Sep quarter when compared with the previous one. India is too integrated into the world economy, today, for capital controls to be brought back.

The latest quarterly balance of payment data released by the Reserve Bank of India shows that the country saw a surge in capital inflows in the period July to September 2007. Net capital flows in a single quarter of USD 34 blllion dollars has been unprecedented in the history of India. This figure was nearly 4 times that of the rather meek USD 8.7 billion that came into India in the same quarter last year. The flows in July-Sept 2007 were more than double the USD 16.5 billion the amount that came into India in the previous quarter, April- June 2007. What is equally striking is that this surge in capital was not caused by a sudden change in policy to open up to inflows. No, indeed, it was the opposite. It was witnessed when India had started moving towards restricting capital inflows such as the restrictions on ECB flows.

Read the entire article here.Saturday, January 12, 2008

AK'Nomics and Deccan Gold Mines.

At the current market price, DGML commands a market cap of close to Rs.700 crore, that for a company which has not produced an ounce of gold so far ! Looks a little far fetched, isnt it? Maybe it is. But, then like I mentioned earlier, it should be seen more as a long term Call option, which if it clicks can turn out to be a big multi-bagger!! Ofcourse, as is the case with options, one stands to lose the entire premium paid....

For those interested in having a look at this company, here are some useful links:

- Company website.

- Annual Reports

- A long and detailed interview with Mr.Sandeep Lakhwara, MD, DGML

- DGML's current projects

Friday, January 11, 2008

Two new listings - Precision Pipes and Aries Agro

Thursday, January 10, 2008

It's a sea of red on Dalal Street...

Wednesday, January 09, 2008

Reliance Power - the most awaited IPO, indeed !!

The much awaited Reliance Power IPO is opening on 15th January 08, with a net public issue of 22.80 crore equity shares, of Rs.10 each, in the band of Rs.405 to Rs.450 per share. Looking at the expected demand from HNI, QIB and Retail, it is a foregone conclusion that book would get discovered at Rs.450 per share.

We all know that QIB category is required to pay only 10% on application in an IPO, while, High Net Worth Investors (HNI) and Retail Category needs to pay the entire amount. This is a cause of dissatisfaction amongst the latter categories as it is not perceived to be a fair level playing and they resent the discrimination between the categories for the same stuff.

Reliance ADAG, has somewhat tried to ease this - firstly by offering a Rs.20 discount to retail category and secondly by asking only Rs.115 per share on application, from HNI and Retail Category. The effective cost to Retail Category would be Rs.430 per share, presuming that book would get discovered at Rs.450 per share.

HNIs generally make application in IPOs by availing IPO finance facilities offered by various investment bankers and stock brokers at an interest rate of 15% to 16% per annum. Due to this facility, (which is to the extent of 90% to 95% in IPO like Reliance Power), an investor is able to leverage it by 10 to 20 times. The duration of finance is generally for 16 to 20 days, during which, the whole process of IPO gets completed.

With only Rs.115 being asked on application, there is huge interest amongst HNIs to apply for the issue. Premium of Rs.370 in the grey market is added attraction as businessmen and traders are also finding it attractive to go for margin funding to earn a return of over 300% per annum, on one's own investment.

Let us try and understand how this works :

An investor wanting to apply for 1 lakh shares, needs Rs.115 lakhs as application money. With 5% margin to be provided by the applicant, he puts in Rs.6 lakhs while Rs.109 lakhs is financed by an NBFC at 16% per annum interest. Assuming fund remains blocked for 16 days, the funding would have an interest burden of Rs.75,000 on Rs.109 lakhs having availed. If HNI category gets subscribed by about 200 times, there would be an allotment of 500 shares. Taking grey market premium of Rs.370 per share, it would give a profit of Rs.1,85,000, which results into a net gain of about Rs.1,10,000 (after deducting interest costs of Rs.75,000), on own investment of Rs.6 lakhs. This results into a return of over 300% on annualized basis.

In HNI category, also called as Non-Institutional Category, 2.28 crore shares being 10% of net issue is reserved, while 30% being 6.84 crore shares are reserved for the Retail Category.

It is a broad consensus that HNI category is likely to get subscribed by about 200 times. If we go by issue size of 2.28 crore shares, in this category and with Rs.115 as application money, it would need Rs.262.20 crore for one time subscription and 200 times would need Rs.52,440 crores. Presuming that close to 95% of this would avail 95% funding, IPO financing from NBFC is estimated to be about Rs.47,300 crores.

Do the NBFCs have the required depth to provide this kind of funding ?

Leading investment bankers like JM, DSP, Kotak, Enam, Edelweiss, Motilal Oswal, Birla, Citibank, Religare have been financing this IPO and book of each of them is running between Rs.3,000 crores to Rs.5,000 crores. But due to huge demand for margin funding, many of them have already made allocations amongst their clients and have closed their books. Also, few of them are now charging interest of upto 20% per annum, against earlier rate of 15% to 16% annually, offered by some of them. Even allocation to each client has been put with a cap of about Rs.25 to Rs.40 crores, per client, on which margin money asked from them is just Rs.1.50 crores to Rs.2 crores.

Surprisingly, huge demand is seen coming from Doctors, Lawyers, Architects, Builders and other leading businessmen, who have never availed this facility earlier for any of the IPOs.

Why this sudden interest ? Strength of IPO or name of Anil Ambani ?

Even in Retail Category, an upfront premium of Rs.7,800 per application is offered by the grey market operator. This is for investors having Demat Account in their name and merely to lend their name for making applications. All the finances are arranged and provided by the broker/operator buying this application.

In this scheme, broker/operator would apply for 225 shares, (maximum permissible in this category), which has a bid value of Rs.96,750 (after considering Rs.20 discount on upper band of Rs.450). The market is expecting an allotment of 30 shares in this category and presuming grey market premium of Rs.370 per share plus Rs.20 discount of Retail investor, this translates into a profit of about Rs.11,700. Of this, Rs.7,800 is offered for lending the name, while Rs.3,900 remains with broker/operator as his share of profit for doing all these exercise.

In Retail Category, 6.84 crore shares being 30% is reserved. Presuming an allotment of 30 shares on 225 shares having applied, market expects subscription level of 7.5 times in this category. This level of subscription would need Rs.5,900 to Rs.6,000 crores. If subscription level exceeds beyond 7.50 times economics of broker/operator would go haywire. One section of market is expecting this category to get subscribed by about 10 to 11 times and hence, find it interesting to sell application at Rs.7,800 in advance.

Looking at the huge interest and response expected for the IPO, you need to agree that fundamentals need not be the sole factor for one to get attracted to an IPO.

----

Article - 2

A right royal abuse of power by Udayan Mukherjee, HT 8th Jan. 2008

The most awaited event of the Indian primary market calendar is here. Reliance Power may have priced its IPO in the Rs 415-450 band but the active grey market price is Rs 900. This gives Reliance Power a potential listing market capitalisation of Rs 2,00,000 crore. With zero installed capacity today, expected generation capacity of 6,000 megawatts by 2011 and 26,000 MW by 2016. NTPC, in itself a richly valued stock, has an installed capacity of 27,000 MW and commands a similar market cap. The market has simply taken an eight year leap and priced it in the Reliance Power stock today. I find that staggering.

A look at the ratios look even more mind numbing. This IPO money is being raised to execute about 7,000 MW of capacity. That should be done by 2012. That year, if all goes perfectly, Reliance Power will have revenues of Rs 7,700 crore, EPS of under Rs 8 and a book value of Rs 70. At the listing price of Rs 900, the stock would be trading at a 2012 price-earning ratio of 110, a price to book value ratio of 13 and a market cap to sales ratio of 26. These are four-year forward ratios, remember. The ratios moderate somewhat for 2016 but by then much further dilution would have happened to finance the additional capacity so the market cap would balloon substantially.

This is madness. While many explanations abound on how such valuations could be justified, this is so similar to the 100-plus PEs the market gave freely to information technology stocks back in 2000. While all of us know how that story finally ended, we should also remember how long that madness continued. The power madness, too, will end, sector tailwind notwithstanding, but it may continue longer than we think it can before fizzling out. While it lasts, the most expensive stock in the sector will become the valuation benchmark and will pull the others into the clouds. Just remember the old adage: those who forget history are doomed to repeat it.

A vertical fall is unlikely till the Reliance Power's IPO

It was the midcaps and the smallcaps that bore the brunt of selling pressure. The BSE Midcap and the BSE Smallcap indices have lost close to 5% over the past few days. Is it a good time to book profits? Probably Not. Till such time as the high profile IPOs such as Reliance Power are out of the way, market sentiment is unlikely to get disturbed. In fact, Market Sentiment will be 'maintained'.

Another important indicator to look at is the options market. If there are more PUT options outstanding, then there is a good likelihood of the markets ending in positive territory or around current levels and vice versa. Reason.

Currently, the number of PUTS outstanding exceeds the CALLS outstanding by over 40%, thereby implying that the markets are on a reasonable wicket and are unlikely to witness a steep level from the current levels.

However, it might not be a bad idea to start booking out of 'over-valued' stocks (e.g. the entire power generation & equipments pack) starting next week (i.e. as we move towards the Reliance Power IPO, which will end on the 19th).

Markets are looking frothy at this point of time...and it is about time one did a fundamental check (Valuations v/s Potential) of his/her holdings.

Sunday, January 06, 2008

IT Education Stocks - Update

1). Education sector new learning curve for investors

In 2007, companies such as Educomp Solutions posted whoppping returns of 374%, while Everonn Systems, which got listed in August 2007, gave returns of 130% in five months in 2007. That’s a lot of money. Not far behind are the old horses such as Aptech and NIIT, which fetched returns of 162% and 124%, respectively, in 2007. Not to forget another emerging IT Education company - Core Projects & Technologies - that delivered over 250% returns during 2007.

2). Business of education catches on with India Inc.

It's boom time for the education sector in India as the concept of 'business of education' catches on with India Inc. Considered a 'social responsibility' all these years till now and plagued by insufficient infrastructure, the Indian education sector has huge room for improvement.

--

Listed stocks in the IT Education space did well in 2007. Can they repeat their performance in 2008? My feeling is Yes, unless the bull run come to an end.

Saturday, January 05, 2008

Indian Primary Market Momentum ???

The clear primary market theme in 2007 revolved around Realty and Infra Structure companies. The big-ticket IPOs that hit the market included DLF, HDIL and Power Grid. Of the three, Power Grid was clearly the most attractively priced, as has been the case with many PSU IPOs – remember Maruti Udyog too ?

Some of the relatively lower profile IPO’s that went on to grab the secondary market spotlight included Vishal Retail, MIC Electronics and Everonn. The high profile loser of 2007, primarily on account of gross over-pricing of its IPO was House of Pearl while fundamentally shaky IPOs like Transwarranty and Broadcast Initiatives bit the dust, post-listing.

Herein, one must call the bluff behind the brain-dead advise that some so called ‘experts’ are doling out to investors, suggesting that every IPO be subscribed to and sold on listing. Well, playing ‘Russian roulette’ might give investors lapping up such gibberish an even greater high, albeit with similar consequences.

Furthermore, wealth is created by holding on to the fundamentally sounder stocks and those who sold the likes of Infosys, Opto Circuits, Divi’s Labs and more recently, Lanco Infratech on listing might well be rueing the day they did so.

Sundaram Finance offers Value amidst an Over-valued financial services pack

- Reliance Capital: Consolidated P/E - 63.2 times

- India Infoline: 115.4 times

- JM Financials: 70 times

- IL&FS: 44 times

- Indiabulls Financial Services: 32 times

- Motilal Oswal: 50 times

- Edelweiss Capital: 100 times

-----------------------------------

- Industry P/E: 66 times

There is one company which is currently available at a significant discount to its listed peers - Sundaram Finance Ltd.

SFL reported a Consolidated PAT of Rs.140 crore for the year ended 31st March 2007. On a 12 month trailing basis, my estimate is that the company's earned a net profit of Rs.160 crore. At the current market price of Rs.837, the scrip is quoting at a P/E of less than 15 times. That too on a trailing basis.

SFL's primary business is hire purchase and lease financing of vehicles (commercial vehicles and passenger cars) and of industrial machinery.

The company also undertakes:

- bill discounting,

- commercial mortgage lending,

- mutual funds (thru Sundaram BNP Paribas AMC),

- home finance (Sundaram Home Finance, partly owned by BNP Paribas),

- general insurance (Royal Sundaram Alliance),

- logistics (infreight logistics),

- financial products distribution (Sundaram Finance Distribution), etc.

Addnl. Points / Counter points ???

Disclosure: I have an open position in this stock in the portfolios that I manage.

Thursday, January 03, 2008

Indian IPO / Primary Market Preview 2008

Tuesday, January 01, 2008

Indian farmer cheers the new US energy bill...

Read the entire article here.

For those of us who have invested in Monsanto India (based on 1 & 2), here's what Chairman of Monsanto India had to say in the aforesaid article:

" Money in hand, farmers are eagerly shopping for the next level of technology, be it drip irrigation or hybrid seeds, because they are more sure of profit. “When farmers succeed, we succeed. Seed and technology companies play a critical role in increasing yield and productivity. We believe the potential is enormous, and the belief is finding more believers,’’ says Sekhar Natarajan, chairman at Monsanto India."

Btwn, the stock has moved up dramatically in the last few trading sessions, up from Rs.1550 (when it was first mentioned on this blog) to Rs.2,170 at the close of trading yesterday.