What is happening to the rupee?

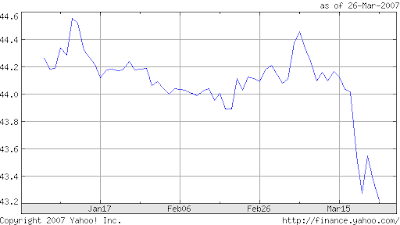

An appreciation of close to two per cent in a span of five working days....and around double that in over a months time!

Has RBI stopped buying dollars from the open market, because the inflows are not as strong to result in a four per cent appreciation in the rupee against the greenback?

Ofcourse, the sharp appreciation in the rupee against the dollar will keep foriegn investors happy since besides the gain from appreciation in stock prices, FIIs also gain from an appreciation in Rupee. This is because for the same amount of rupees, currently invested, they stand to earn more dollars.

However, Indian IT companies wont like this sharp appreciation in rupee. Since they are exporters of services and earn their revenues in dollars, they will get less rupees for the same number of dollars compared to a month ago. Their margins will take a hit if the rupee appreciation continues.

here's a small and a very simplistic example:

- Company: Infy

- Size of order executed: USD 100 million

- Order finalised in say Feb: when the conversion rate was Rs.44.5 to a Dollar.

- Infy accordingly submits its quote, gets the order and executes the same.

- It stands to earn a 20% margin, ie. USD 20 million or if converted into INR (@ 44.5), Rs.89 crore.

- Suppose INR to a Dollar appreciates to Rs.42.8 (as is the case now). For its USD 20 million, Infy will now recieve (20,000,000 x 42.8) = Rs.85.6 crore or a loss of Rs.3.4 crore.

Watch out for a weakness in IT counters on the bourses. Infact, its not just the IT companies, but also garment exporters (Gokaldas, for eg)., and pharma companies.....

2 comments:

Iam Gopi Reddy working as a Business Analyst in an IT company ..Iam into Ankur right from Rs 70 levels and keen

follower of the stock .But one of my friend referred your blogger and your analysis on Ankur is quite amazing and is adding new dimensions to my thoughts .Really i appreciate it .If you are interested will exchange

info on some of my recent stock picks

My email id is vangored@yahoo.com .please mail me yours

You are right, Tiberius. Remittances are indeed one big source of forex for us....and am sure there the effect is fairly quickly felt..by pple who receive those monies back hme. one will have to check the numbers and study the trend to understand this better.

Post a Comment