Thursday, November 30, 2006

Tuesday, November 14, 2006

What is so special about Unitech?

Monday, November 13, 2006

Booked partial profits in Ankur Drugs; +ve outlook on saw pipe companies

Between, HDFC Securities has come out with a report on the domestic Saw Pipes industry. The outlook is very positive given the kind of investments happening in the petroleum industry across the globe and in various sewage and irrigation projects in India. HDFC Securities expects the companies in this sector to outperform over the next 2-3 years. The companies are:

Man Industries, PSL, Jindal Saw, Welspun Gujarat, Maharashtra Seamless and Ratnamani Metals and Tubes. Download the entire report from here.

Wednesday, November 08, 2006

Noteworthy performers in my folio: Ankur Drugs, Man Industries & Subros

1).Ankur Drugs

Sales: Rs.61.5 cr, up 77% y-o-y,

PAT: Rs.7 cr, up 133%,

P/E: 7.25 times.

2).Man Inds.

Sales: Rs.292.6 cr, 60.5%,

PAT: Rs.14.8cr, 85.7%,

P/E: 12.1 times

3).Subros

Sales: Rs.165.8 cr, 26.8%,

PAT: Rs.7.8 cr, 92.6%,

P/E: 10.6 times

4).Raj. Spg & Wvg Mills

Sales: Rs.235.8 cr, 15.6%,

PAT: Rs. 7.2 cr, 18%,

P/E: 9.7 times.

I expect these companies to sustain this performance over the next two quarters. My personal price targets for these are:

Ankur - Rs.180+ (buy price - 92)

Man Inds - Rs.275+ (buy price - 214)

Subros - Rs.300+ (buy price - 167)

Raj.Spg - Rs.170+ (buy price - 120)

I had recently written about SPL Industries. I bought this scrip at around Rs.42. But it has since slipped to Rs.33. Reason: One of the worst performances since the company got listed. Thus far it earned around Rs.3-4 crore per quarter during each of the last two years. However, the Sept'06 quarter turned out be exceptionally bad. Its profit declined by over 90% to a few lakhs. Not surprisingly, the stock has slipped by around 25% since I bought it. The 'cigar butt' really hit me tight on my butt :(

Monday, November 06, 2006

India Infoline up 20% today?

Update: 7-Nov-06: The scrip went further up today. Closed the day at 279, up 11% over the previous close. That means a gain of around 40% since I wrote about it a few days ago...phew!!

Another update: 9-Nov-06: India Infoline is up another 12% today. And is currently quoting at Rs.296. Intra-day high for the scrip was 306.....some run-up this!!

Monday, October 30, 2006

Shaking foundations, says the Time on Mr.Ratan Tata

You wouldn't expect the head of Tata group, India's largest conglomerate, to say the rich are boring. But Ratan Tata comes close. Acting rich doesn't interest him. "I've never had the desire to own a yacht, to flaunt," he says. Nor does the Prada-wearing class excite him as a marketing opportunity. China and India, with their growing ranks of tycoons, should attract multinational businesses, not because of the spare million in a few fat wallets, he argues, but because of the spare change in a billion slim ones. "Everyone is catering to the top of the pyramid," says the 68-year-old at his office in Bombay House, Tata group's elegant Edwardian headquarters in India's business capital. "The challenge we've given to all our companies is to address a different market. Pare your margins. Create new markets."

Always a great feeling to see an Indian company taking up the challenge of becoming global and then becoming one. Unlike in the past when some of the great Indian brands simply sold out to MNCs. The best example that I can think of is the sell-out of the soft drink brands - Thumbs Up, Limca, & Gold Spot. I think these brands had in them what it takes to be global....maybe there promoters did not. The entire article on Mr.Tata in the Time Magazine can be read here.

Saturday, October 28, 2006

Why do we have a 10-digit mobile number? Why not 6/7/8/9-digit?

The logic: The number of digits in a mobile phone number decide the maximum mobile phones we can have without dialing the country code, ie. 91 (for India). To understand this we need to go back to school. Remember permutations & combinations. Suppose I had a pair of jeans (J1-2) and four tee-shirts (T1-4). The possible combinations are: J1T1, J1T2, J1T3, J1T4, J2T1, J2T2, J2T3, and J2T4, ie. 8 combinations {2 (no. of jeans) X 4 (no. of tee-shirts)}.

The same logic is used when computing the digits in a mobile phone number or for that any numbers such as those for vehicles, land-line telephone numbers, etc. Now suppose if we had a 6-digit cell number, the maximum number of unique cell numbers possible would have been (10 x 10 x 10 x 10 x 10 x 10), ie. a maximum of 1,000,000 subscribers. We have already crossed the 100-million mark in India. So obviously we could not have had a 6-digit cell phone number. Not even a 7-digit because that would've resulted in a capacity of 10 million, not even 8-digit (100 million subscribers), and not even a 9-digit (ie. 1000 million or 100 crore, since our population is close to 125 crore and growing).

A 10-digit cell number offers us a capacity to have 10 billion (1000 crore) subscribers, which is far more than what our country can even achieve. We are v.v.v.unlikely to have a population or a subscriber base of 1000 crore but there is a remote likelihood of us having 100 crore subscribers. Hence, a 10-digit mobile phone number.

Friday, October 27, 2006

Who is financing India's largest LBO; Tata Steel-Corus deal

The financing package accompanying Tata Steel's $8.23 billion leveraged buyout of UK steel producer Corus is multi-faceted. The deal, which sees Tata assume some debt on the Corus balance sheet and agreed pension liabilities, comprises a $3.88 billion equity contribution from Tata Steel, a fully underwritten non-recourse debt package of $5.63 billion, and a revolving credit facility of $669 million. The deal represents India’s largest cross-border outbound acquisition ever and also the largest leveraged buyout (LBO) attempted by an Indian company.

Tata Steel appointed ABN AMRO and Deutsche Bank to advise on the transaction and raise the required financing for the acquisition. But somewhere along the way, the appointed banks were unable to commit the debt required. Sources close to the deal suggest the transaction was almost derailed at this stage.

So Corus turned to a bank it was close to, Credit Suisse, to resolve the impasse. Credit Suisse was advising Corus on the Tata deal.

Read the full article here.

Wednesday, October 25, 2006

Early bookings on! Take ur pick in the domestic broking biz, Investsmartindia, Geojit, Indiabulls, Sharekhan....

1). Sharekhan (Promoted by SSKI): Interested parties - New Atlantic Partners and IDFC.

2). Investsmartindia (Promoted by IL&FS): E*Trade.

3). Geojit Financial Services: BNP Paribas.

4). Motilal Oswal: New Vernon Private Equity Ltd and Bessemer Venture Partners.

5). Indiabulls: No single strategic investor. But there seems to be a beeline of foriegn investors for this company. They have a phenomenal 53 per cent stake in this company. See the Sept'06 shareholding pattern.

I think quite a few of these will be sold off sooner than later. Their share prices have witnessed good jump in recent times. However, among the listed broking firms, there is one company called "Indiainfoline". This company has so far remained out of the limelight. Difficult to believe that it hasn't been approached by any of the large foriegn investor yet. I think something could be cooking up here as well. My conspiracy theory is that it will be bought out by Anil Dhirubhai Ambani's new venture R Trade. Having already missed the rally in Indiabulls, IL&FS Investsmart India, Geojit; Indiainfoline is a company one should watch out for in days to come.

Saturday, October 21, 2006

Indian Banks: As shareholders we cheer, but as your customers we cry!

Sharad Jain, an HDFC Bank account holder was happy to learn that he had pre-qualified for a Gold Credit card, but his application was rejected on processing. After persistent efforts he was shocked to discover that some bank had entered his name on the ‘defaulters’ / negative list. Jain says that he has several credit cards and has never defaulted on any account, and in fact enjoys an excellent credit rating.

A few years ago, RBI allowed the creation of the Credit Information Bureau of India Ltd (CIBIL), which is a databank of individual credit histories. Banks can subscribe to CIBIL’s services to check the credit history of prospective customers and weed out habitual defaulters or trouble makers. But the law that enabled the setting up of CIBIL deliberately did not provide any recourse to customers victimised by banks. I say deliberately, because such recourse was already available in the US and CIBIL has a tie-up with the best global name in this business.

RBI later tried to make amends through the Credit Information Act, which has already been passed by Parliament. However, unless rules and regulations under the Act are framed and notified (they will again need approval from Parliament), the passing of the Act is meaningless to consumers.

Jain has been told that his only recourse is a Consumer Court — not even the Banking Ombudsman. Or, he can persuade his bank to informally help him discover which bank reported him as a defaulter and then have the entry corrected. He tried that, but HDFC Bank, which had pre-qualified him for a gold card refuses to help. Jain is not the only sufferer. A few months ago, the HR chief of a multinational company discovered that the bank, whose credit card he still uses regularly, had wrongly reported him as a defaulter.

Ironically, even the RBI does not seem to be able to resolve this complaint by accessing the CIBIL database. Banking sources tell us that people whose combination of name and surname are common will be more prone to suffer from such mistakes. If this is obvious, why was consumer interest not a part of the statute that protects banks?

The entire article can be read here.

I've had bad experiences with one such bank - Andhra Bank. They have one of the most dismal customer response service. My debit card got stuck in an ATM machine thrice over a period of three months and each time the bank took over a months time to reverse the amount that was debited from my account. Yes, my card got stuck in the ATM machine and I did not get any cash out of it and yet it was debited from my a/c. While it is fine till here, I mean this can happen. But, when you ask the branch manager about the reversal the usual answer was "Sir, this is a PSU. Do not expect us to reverse your debit transaction so quickly. It will take atleast 15 days to reverse the same. Please come after two weeks to check the status." The two weeks got extended to over a month the first time around and a little less than a month in the remaining two instances.

Another bad experience with the same bank was of non-availability of Andhra Bank's owned ATM machines. In early days, we were allowed free withdrawals from some of the other banks such as SBI & associates and IDBI bank. But a few months ago, the bank said it will charge us for any transaction from a non-Andhra Bank ATM machine. This to us was insane. From where our office was located: a). there was no Andhra Bank ATM machine, and b). the immediately accessible ATM machine was located in Bandra (30 mins from my office), Borivali (again 30 mins from office) and Ghatkopar (some 30 odd mins again). So in effect the bank was saying I will give you ATM service but in two ways, either you use my non-existent ATM network and do your transactions for free or alternatively use other banks ATM and pay a charge. If the bank had a ATM network as strong as ICICI's or UTI's then one would have accepted Andhra Bank's logic. But when you have a mere 3-4 ATMs between Borivali and Bandra, there is a problem. Ofcourse, the bank had no problem at all. Because, it does not care. It derives most of its biz from Andhra Pradesh and not from Mumbai...so I am sure it is ok with it. And, ofcourse, we too did a "Good bye Andhra Bank".

Thursday, October 19, 2006

Its Diwali in India and on the Wallstreet!

Wednesday, October 18, 2006

Stock markets and 'denigration of history'

Reality is far more viscious than Russian Roulette. First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands of chambers instead of six. After a few dozen tries, one forgets about the existence of a bullet, under a numbing false sense of security. This is related to a problem called denigration of history as gamblers, investors, and decision makers feel that the sort of things that happen to others would not necessarily happen to them.

Second, unlike a well-defined precise game like Russian Roulette, where the risks are visible to anyone capable of multiplying and dividing by six, one does not observe the barrel of reality. Very rarely is the generator visible to the naked eye. One is thus capable of unwittingly playing Russian Roulette - and calling it by some alternative "low risk" name. We see the wealth being generated, never the processor, a matter that makes people lose sight of their risks, and never the losers. The game seems terribly easy and we play along blithely.

The note reflects how investors tend to behave during bullruns. Valuations are pushed up to unrealistic levels like they were once in case of IT stocks during 1999-2000. IT companies such Infosys, Wipro, Satyam, HCL Tech, etc. were all trading at P/Es of over 70-75 times. Investments in these companies at that point would have probably evened out now, ie. after six years. Atleast, these evened out. What about investments in scrips like Global Telesystems, Himachal Futuristic Communications, Silverline, Zee Telefilms, Pentamedia, etc.? I am sure these will never recover, atleast not in this lifetime. Though some like Silverline Technologies are trying hard to get investor interest as can be seen by these announcements: 1, 2 and 3. I think they are best avoided.

Do we see such instances of "denigration of history" in todays markets? Maybe. I think real estate companies could belong to such a category. Companies such as Unitech, Mahindra Gesco Developers, Phoenix Mills, Ansal Properties & Infrastruture. These companies are trading P/Es of between 50-240 times. With the bigger companies trading at even higher P/E ratios. Unitech is quoting at a mcap of over Rs.25,000 crore. This for a company that earned a mere Rs.135 crore over the preceding four quarters. Something sounds really inexplicable there. There were news reports that DLF, a Delhi-based real estate developer which is coming out with an IPO was expected to be valued at a phenomenal mcap of over Rs.100,000 crore. All this sounds crazy to me. Maybe I am wrong, but I would like to proven wrong, convincingly. Will monitor these companies closely over the next few quarters.

Btwn the book "Fooled by Randomness" is simply awesome. A must read for any investor.

Wednesday, October 11, 2006

Wow, what a company! Infosys Technologies (INFY).

Q2'07 - 50.8%

Q1'07 - 45.7%

Q4'06 - 31.2%

Q3'06 - 33.3%

Q2'06 - 28.4%

Q1'06 - 33.7%

All this while the company has been successful in earning net margins of around 24-25%. For greater details of the company's results check the link.

Now for the interesting part, the future and how it can pan out:

The company's FY'07 sales forecast of Rs.13,853 crore and PAT forecast of Rs.3,437.8 crore looks to be on course. Taking these into account, the average annual growth over the past five years comes to around 48.8 per cent in sales and 40.5 per cent in net profit. Lets use these numbers to get some idea of the future:

Scene 1 - Most optimistic: The company retains this CAGR over the next five years.

Sales at the end of year 2012: Rs.101,055.2 crore (Phew!!)

Net profit @ end of year 2012: Rs.18,821.9 crore

Probability of this happening: 1% (Since nothing can be ruled out in this world...not even this unlikely scenario).

Scene 2: Optimistic: The CAGR halves to 24.4% and 20.25%, respectively.

Sales at the end of year 2012: Rs.41,271.1 crore

Net profit @ end of year 2012: Rs.8,643.9 crore

Probability of this happening: 49%

Scene 3: Pessimistic: The CAGR drops to 10% at both the topline and bottomline.

Sales at the end of year 2012: Rs.22,310.4 crore

Net profit @ end of year 2012: Rs.5536.6 crore

Probability of this happening: 50%

Summing up of all probabilities:

Estimated sales @ end of year 2012: Rs.32,388.6 crore.

Estimated net profit @ end of year 2012: Rs. 7,192.0 crore.

Discounting the NPAT of year 2012:

P/E = 10 times, Mcap = 71,920 crore

P/E = 15 times, Mcap = 107,880 crore

P/E = 20 times, Mcap = 143,841 crore

P/E = 25 times, Mcap = 179,800 crore

A P/E of 25 times five years down the line maybe difficult to achieve, given an estimated growth rate of less than 20%. I think a more realistic P/E ratio would be somewhere close to 20 times. That would take Infosys' target mcap to Rs.143,841 crore. Given that its current mcap is around Rs.110,000 crore, there could be an upside of 31 per cent over the next five years. Translate this into a CAGR and the return per annum over the next five years could be in the range of 5.5 per cent.

Which brings me to a question: Is Infosys a good investment at these levels?

PS: The analysis would mostly seem naive and quite honestly it is. I have no great knowledge of the software industry and nor am I very good at predictions. Its just a rough extrapolation of the company's performance over the last few years. But, I think I can confidently claim that a repeat of last five years performance will be highly unlikely over the next. I think the company's growth rate would come down dramatically, as it did during 2001-06, compared to over 100% growth during 1996-01.

Thursday, October 05, 2006

A cigar butt (cheap stock): SPL Industries

Reasons for buying the scrip:

1).P/E < 10 times

2).P/B < 1 times

3).EV/EBDITA < 7 times

4).Debt-to-equity < 1 times

5).Stable growth

6).Healthy margins

7).Interest cover > 3 times.

Downside risk: Not much at current prices.

Earnings shock: Likely in a scenario where raw materials witness a sharp jump (unlikely in the near term). The main raw material for the company is yarns, production capacity of which is rising at a rapid pace. Most of the yarn companies in India are expanding there capacities by leaps & bounds, in anticipation of higher demand from domestic garments companies in the post-MFA era.

Upside: 20-30% with no growth from current levels. Could he higher, if the company is able to maintain the growth of the last two quarters.

Conclusion: SPL is a classic "cigar butt" (in Charlie Munger's words), it is trading at a significantly modest valuations at current prices vis-a-vis other garment manufacturers like Gokaldas Exports, Zodiac Clothing, etc. I think even if the company were to not record any growth over the next few years, it should still be trading at a 9-10 times its earnings, giving an upside of around 20%+.

Thursday, September 28, 2006

For all the "wannabe" jesse livermore's, here's some nice advice

Suppose I offer you a sure $500 or the choice of flipping a coin. If the coin lands on heads, you'll get $1000. If the coin lands on tails, you'll receive nothing. Would you take the guaranteed $500, or would you flip the coin?Most people, given the opportunity for a sure thing, will take it.Now, however, suppose I confront you with a certain *loss* of $500. The alternative is that you can flip a coin. If it lands on heads, you lose nothing. If it lands on tails, however, you lose $1000. Would you take the guaranteed loss of $500, or would you flip the coin?Interestingly, in that scenario, a significant number of people will flip the coin. We tend to be more risk-seeking when we deal with losses than when we are faced with gains.

Suppose we are into a trade and can take a sure point out the S&P eminis in a short-term trade. Do we "take what the market gives us"? Suppose the market moves four ticks against us. Do we hold the loss in hopes of coming back to breakeven?There is a meaningful difference between trading to win and trading to not lose. The average person feels more psychological pain over a loss than they feel pleasure over a gain--particularly once they have already "booked" that gain mentally. If I'm expecting a bonus from my employer, I'll be happy when I receive the paycheck--but I'll be much more upset if I find out the bonus has been rescinded. When we enter a trade, we expect to be paid out. Mentally, we book a potential profit. When a loss materializes, it is the unexpected event--and we respond more strongly to the unexpected than to the familiar.

What is the solution to this dilemma? The answer, surprisingly, is to book losses before they occur.

It's human nature to not want to think about such unpleasant things as losses. But by knowing our maximum possible loss in advance and by mentally rehearsing what we'll do on those occasions when the loss occurs, we normalize the losing process. That divests it of its emotional grip. We can never eliminate loss from life or trading; nor can we repeal the basic uncertainties of markets. What we *can* do is develop an edge in the marketplace and, over the course of many trades, let that edge accumulate in our favor. And, if you're trading well, maybe that losing trade will offer you a fresh perspective about how the market is trading: an insight that can make you money the next time around. Then it's not a loss. It's information that you've paid for.

The article can also be accessed here. Brett Steenbarger's blog is a must read for any trader.

Wednesday, September 27, 2006

Testing market efficiency?

Three companies, in which I am currently invested - Ankur Drugs, WS Industries, and Jyoti Ltd, are expected to report robust financial performance for the quarter ended Sept'06. They will most likely report their numbers sometime after mid-October.

I will be monitoring share price of these companies over a months period, from 20-Sep to 2o-Oct. If these scrips end up posting significantly excess returns over the benchmark index, NSE Nifty, during this period, then there is a case of insiders releasing the information to interested market participants or buying shares themselves.

Cont...

Investment update: WS Industries up by over 30% in two sessions?

Friday, September 15, 2006

FIIs account for a lot more than what meets the eye!

FIIs own close to 20% of all the Nifty companies. The shareholding pattern of companies available at the end of every quarter indicates that this is indeed the case. However, if adjusted for the free-float, their stake increases to around 40%, which is quite substantial! And, which is why I think they matter a lot more than what is believed. While this was only a small analysis of the Nifty 50 companies, which account for something like 50-60 per cent of the total mcap of Corporate India, one can do a more broad-based analysis by studying the S&P CNX 500 numbers.

A few examples (numbers as of 31-Aug-06 from here):

ONGC:

>> Mcap: Rs.1.4 lac crores,

>> Free-float factor - 0.2,

>> Free-float mcap - Rs.28,000 crore

>> FIIs stake (over total mcap and not FF mcap) - 9.4%

>> FIIs share as a % of free-float mcap - (0.0943 * 1.4 lac crore) / (28,000 crore) = 19.2%

Reliance Industries

>> Mcap: Rs.1.39 lac crores,

>> Free-float factor - 0.55,

>> Free-float mcap - Rs.76,000 crore

>> FIIs stake (over total mcap and not FF mcap) - 19.8%

>> FIIs share as a % of free-float mcap - (0.198 * 1.39 lac crore) / (76,000 crore) = 36%

FIIs share goes up substantially in case of companies such as ICICI Bank, Infosys Technologies, HDFC, HDFC Bank, Bharti Airtel, etc. where a). FIIs have significantly higher stakes and b). the free-float in these companies is also pretty high.

All in all, the numbers indicate that FIIs own and can therefore influence more than what meets the naked eye.

Monday, September 04, 2006

Investment update: Subros (value pick)

Why I was and remain bullish over the company's prospects:

- Subros is one of the largest manufacturer and supplier of air conditioning systems to big car manufacturers in India (Maruti and Telco),

- it has over 50% share in the domestic market,

- trades at a P/E of less than 10 times,

- pays a decent dividend (Rs.3.5 per share for fiscal 2006),

- both Suzuki and Denso have strategic stakes of 13 per cent each in the company, and

- going forward it seems poised for healthy growth, given the company expansion plans (1 and2).

PS: Sharekhan and Kotak Securities have recently (in April-May 2006) put a buy on Subros with a price target of Rs.370 per share & Rs.280 per share. It was up some six odd per cent to Rs.224 per share. A value pick.

Friday, August 25, 2006

Indian stock market.........valuations revisited!

Each of the above three valuation parameters are not too far from their seven years average levels. One can, therefore, say that Indian markets are currently fairly valued. Definitive moves from here on will have to necessarily be driven by higher earnings accumulation.....not just growth. Till such time I think the markets will consolidate and stay at around current levels, within a band of say 5-10%. I had done a similar study a few months ago.

Thursday, August 24, 2006

Update: New investment - Ankur Drugs & Pharmaceuticals

Promoters buying shares from the secondary market is a fairly strong signal. This is because unlike selling , buying is a voluntary decision. People can end up liquidating some of their holdings for reasons like buying a new house, repayment of some loan, etc. The bottomline is selling can be a forced decision. Whereas buying shares (making investments) is mostly voluntary, unless you are a large steel manufacturing company. Noteworthy is the fact that pple make investments only when they think that the investment they are making is the one that CAN yield the highest return for them at a reasonable risk.

Therefore, I for one am quite bullish over the fact that Ankur Drugs is a). recording robust growth in its business and b). the promoters in the company too feel the same. Not just promoters, Reliance Capital (one of the largest and best performing mutual funds) too feels the same. It picked up a 9.5% stake in Ankur Drugs in November last year.

Disclosure: I've a long position in the company bought at Rs.92 per share. I bought these 2-3 days prior to my blog entry on this company. The stock has since moved by over 45% and is currently trading at around Rs.137. I expect the company to report a PAT of over Rs.20 crore for the fiscal 2007. Discounting this by a multiple of 8-10 times gives me an approximate price target of Rs.180-200 per share.

More updates: Dilution of equity due to the conversion of FCCBs

I had done some rough computations on the likely effect of the conversion of the 16,000 FCCBs (amount: USD 16 million) issued by the company in May this year. Here's how they look:

1).Assuming the FCCBs get converted at a price of Rs.100 per share.

2).No. of additional shares would amount to around 7.4 million shares.

3).Current shares outstanding is 9.5 million.

4).Shares o/s post the conversion would amount to 16.9 million.

5).With a NPAT of Rs.42 crore (as claimed by the company's head), year end EPS would stand at Rs.24.9 per share.

Tuesday, August 15, 2006

Independence Day wishes to all & some nice articles to read

Found some nice articles to read:

1). IBM's India Plan Shows Need to Boost Talent by Andy Mukherjee.

2). What Trading Teaches Us About Life by Brett Steenbarger.

3). Trader Performance: What Contributes to Profitability? by Brett Steenbarger.

Saturday, August 12, 2006

New investments - Ankur Drugs & WS Industries

Ankur Drugs & Pharmaceuticals is a small company which primarily does contract manufacturing for large pharma companies in India. The company recently commissioned a new plant in North India, impact of which can be seen in its recent quarterly performances. Sales and profits grew by over 200% in each of the last two quarters.

WS Industries is a leading manufacturer of high voltage electro-porcelain transmission and sub-station insulators in India. These are primarily used in the electrical transmission and distribution sector. The company is expected to do well in the wake of the current investment boom. I am still studying the company and its business. But, from whatever I've read so far, WSI looks promising. I've made a token investment in this company for now. Will up the ante after a detailed study.

My current folio includes:

1).Man Industries

2).Rajasthan Spinning & Weaving

3).Morarka Finance

4).Dishman Pharma

5).Subros

6).Jyoti Ltd

7).Deccan Gold Mines

8).Ankur Drugs

9).WS Industries

I've written about my investments in the past: 1, 2 and 3.

Update: Both Ankur Drugs and WS Industries ended up today (14-Aug-06), 1.3% and 10% respectively.

Friday, August 04, 2006

Warren Buffet errs too...but what the hell he is and will remain the best ever!

Billionaire investor Warren Buffett, stung by $955 million in losses from foreign-currency investments in 2005, slashed his bet against the U.S. dollar this year, just before its steepest decline in 18 months.

Berkshire Hathaway Inc., his Omaha, Nebraska-based insurance and investment firm, had $5.4 billion in foreign- currency forward contracts at the end of March, down from as much as $21.8 billion in 2005, according to the company's earnings statements. The U.S. Dollar Index, used to measure its value against six major currencies, fell 5.1 percent in the second quarter.

Btw, for better insights into the world of investment there's no better reading material than WB's annual "Letter to shareholders". They can be found here.

Toyota > 2 * (General Motors + Ford + Daimler Chrysler)

The top five producers are:

1). General Motors - 9.04 million

2). Toyota - 7.1 million

3). Ford - 6.4 million

4). Volkswagen - 5.17 million

5). Daimler Chrysler - 4.3 million

However, by market capitalisation the equation is a little different (well, actually a lot different):

GM's mcap = USD 18 bln

Ford's mcap = USD 13.2 bln

Daimler Chrysler = USD 52.2 bln

Thought: With a mcap of USD 6 bln, what will it take for one of India's largest auto companies - Tata Motors to make a hostile bid on Ford Motors, which has a mcap of a mere USD 13.2 bln. Hmm....food for thought for Mr. Ratan Tata. Silly many will think.....but why should any Indian company - be it Maruti Suzuki or Tata Motors not make this bid?????

Saturday, July 29, 2006

Fooled by Infomedia India!

- Infomedia India Ltd has informed BSE that the Hon'ble High Court of Judicature at Bombay has approved the Scheme of Arrangement between the Company and the equity shareholders of the Company u/s 391 read with sections 100 to 103 of the Companies Act 1956 filed by the Company for purchase and consequent cancellation of its equity shares on June 16, 2006.

The company announced the record date for the event on 26-July-06. Everything seemed fine till then as many of my close friends and I bought 49 shares each in our accounts. We were quite happy to get this "free lunch". But that was not to be.....

The company revised its announcement on 27-July-06 and came up with a shocking modification to the SoA. As per the new SoA -

- The Shareholders holding 50 (fifty) Equity Shares or less per ledger folio in physical form and / or per Client ID in dematerialized form on June 16, 2006, shall have an option of tendering their entire Equity Shares for purchase by the Company and the Company shall purchase the Equity Shares tendered for a consideration of Rs 245/- per Equity Share.

In the end we all exited the counter at cost (just about recovering brokerages paid, thankfully!) I think this was a case of sheer bad luck.....since the "risk-free" continues to rest with those pple who bought the shares prior to 16-June-2006. Plain simple bad luck, I think.

Friday, July 28, 2006

Interesting measures of risk & return on the Nifty

- On any given day, the change in Nifty will range from -1.6% to +1.6%, with a 68% probability. Thus, a 1% move is either direction is random, in the grand scheme of things.

- The average intraday range is ~2% with std-dev of 1.5%; thus, what might seem like a very volatile day may not really be so.

- If we separate UP & DOWN days, we realize that even a 2% move is not beyond normal expectations.

Read the full article here. It will be interesting to know whether these stats have any predictive value? Or more importantly, can one use such data points to predict returns?

Tuesday, July 25, 2006

Are we following the US? RBI hikes interest rates by 25 basis points

I am not an expert in monetary economics but I would like to understand a few things:

Lets begin with the basic question: Why does the RBI feel the need to hike interest rates? Probably because it feels that inflation is acquiring dangerous proportions and would therefore like to anchor inflation expectations. But, a WPI at 4.9 per cent is certainly not dangerous. In fact, it is less than the last two years average (5.9 per cent), less than last five years avg (5.2 per cent), less than even the last 10 years avg (5.2 per cent), there's more...it is less than even the 34 yr avg (7.98 per cent). So what is it that the RBI is worried about?

Another problem is that the current rise in the rate of inflation is primarily driven by supply constraints and not excessive demand. That brings me to another question: When faced with supply shocks should the central government hike interest rates or take the "reduce import duties" path(?). Inflation today is driven by food articles and petroleum products. While nothing can be done about the latter, import duties on the former can certainly be reduced. Thankfully, the government has taken some measures on that front, eg. sugar, wheat..etc. Shouldn't it be doing the same wherever it can?

...to be continued.

Sunday, July 23, 2006

What increases shareholder value - dividends or buybacks?

Dividends are profits earned by a company and shared with its shareholders. So if a company earns let say Rs.100 crore in the current year and has retained profits of earlier years amounting to another Rs.500 crore, it technically has Rs.600 crore which belongs to the shareowners and can therefore be shared with them by way of dividend payouts. Economists, financial consultants and ofcourse companies across-the-globe have long argued that dividends are a way of rewarding shareholders or put simply sharing some of the profits that the company has earned.

However, do dividends really add to your wealth? I think not.

Reason: Share prices on the bourses quickly adjust (read: decline/fall) by the same quantum almost immediately. That means, if I owned a share worth Rs.100 & which paid a dividend of Rs.10 per share, the stock will immediately fall by Rs.10 on the bourses on the ex-date. So where is the reward/gain....?

Next is buybacks: Companies announce buybacks when they have ample cash (more than what is required to run & expand the business) in their books and instead of paying direct cash to the shareholder they offer to buy shares from the market at a price which is higher than the prevailing market price (that is obvious actually). Microsoft recently announced one.

So how does a buyback benefit a shareholder?

The answer is: It does not to the shareholder who sells out to the company, but benefits the one who does not. The reason is quite simple, shares bought back under a 'buy-back' scheme are cancelled thereby reducing the total shares outstanding. Reduction in shares results in an increase in the earning per share, which pulls down the price-to-earning ratio. If the company is well-run then a lower p/e ratio will attract new investors, driving up the share price.

However, buy-backs increase shareholders wealth only when done in the form of a 'tender-offer'. In recent times there have been cases where companies have announced buy-backs but not in the form of tender offers but by offering to buy shares from the secondary market at a price they feel right. Put simply, the management has no obligation to buy its share back under this form of buy-back and guess what more often than not it actually ends up buying no share, eg. Reliance Industries (in 2002-03), SRF Polymers and SRF Ltd (more recently).....etc.

Bottomline: Dividends do not add shareholder value, not anymore. Tender-offers do, but plain buy-backs do not.

Sunday, July 16, 2006

Ratio analysis trivia: Return on capital employed?

Return on Capital Employed (ROCE) is used in finance as a measure of the returns that a company is realizing from its capital employed (Total assets - current liabilities). The ratio can also be seen as representing the efficiency with which capital is being utilized to generate revenue. It is commonly used as a measure for comparing the performance between companies and for assessing whether a company generates enough returns to pay for its cost of capital.

The formulae used is: (Profit before interest & taxes) / Avg. Capital Employed

There is another way of computing this ratio:

(Profit after tax + Interest) / Avg. Capital Employed

The argument here is that since the capital employed can be broken up into two components: owners capital and borrowed funds, one should look at the returns to individual components, ie. return on owners fund and the return on the borrowed funds. From a company's perspective the same thing would be to find return on owners fund and cost of borrowed funds (interest). The return to shareowners is the profit after tax and the cost of borrowed funds is the interest. Simply put, PAT + Interest is the return that a company generates to from the capital employed.

The difference between the two ratios is that the first one takes pre-tax return on capital employed whereas the second computes the post-tax return over capital employed.

The question: which of these is the right way of computing the return on capital employed?

Tuesday, June 27, 2006

So long as we act inefficiently, the efficient market hypothesis will hold(?)

In finance, the efficient market hypothesis (EMH) asserts that financial markets are "efficient", or that prices on traded assets, e.g. stocks, bonds, or property, already reflect all known information and therefore are unbiased in the sense that they reflect the collective beliefs of all investors about future prospects. The efficient market hypothesis implies that it is not possible to consistently outperform the market — appropriately adjusted for risk — by using any information that the market already knows, except through luck or obtaining and trading on inside information. Information or news in the EMH is defined as anything that may affect stock prices that is unknowable in the present and thus appears randomly in the future. This random information will be the cause of future stock price changes.

There are three versions to this hyposthesis:

1). The Weak form: No excess returns can be earned by using investment strategies based on historical share prices or other financial data. Conclusion - Technical analysis cannot earn excess returns.

2). The semi-weak form: Share prices adjust within an arbitrarily small but finite amount of time and in an unbiased fashion to publicly available new information, so that no excess returns can be earned by trading on that information. Conclusion - Fundamental analysis will bear no fruit.

3). The strong-form: Share prices reflect all information (inside or otherwise) and no one can earn excess returns. Conclusion - Even insiders cannot earn excess returns.

The entire article on Wikipedia rightly points to the fact that investors need not be rational for the EMH to hold or else how can one explain the excesses of the IT boom and many such booms on the yesteryears.

But if looked closely one can say that the EMH principle actually holds because market players are irrational or rather inefficient in their actions. Which means markets on the whole remain efficient so long as investors are inefficient/irrational. And, if most investors turned to index funds (believing into the efficient market hypothesis), the markets may no longer remain efficient and sustained outperformance can be achieved............hmm.......interesting (looking for more wisdom on this?)

Sunday, June 11, 2006

Take a holiday, says Marc Faber

In his investment report for June 2006, Marc Faber recommends selling investments at any pull-back rallies during the next few months. He expects a further 30 per cent slide in many of the emerging markets. Read the full report here.

Btw, the decline did throw open some good buying opportunities on Thursday. I picked up CREW BOS Products and Reliance Comm. Ventures Ltd. They went up 20% each on Friday. I think I am going to be trading mostly (something I dont do....!!) in these markets to take advantage of extreme reactions.

Trivia: Will markets resume their journey downsouth or will it consolidate next week or will it claw-back above the 10,000 mark?

Thursday, June 01, 2006

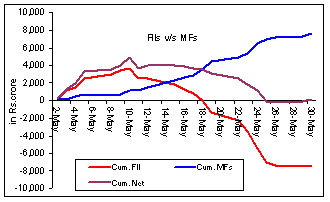

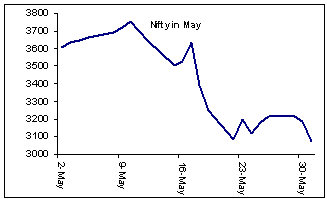

FII investments v/s MF investments and Nifty in May(?)

Yet, the benchmark Nifty ended the month with a decline of 14.8 per cent. From the high of the month, the index ended 18.2 per cent lower.

Some questions:

1.Why should the markets decline as much as they did, when two of the major players in the market (FIIs and MFs) simply swap holdings, as indicated by their transaction figures(?)

2.Besides, since institutional activity remained marginally positive (net-net, ie.), who sold big(?)

3.Most of the fund managers who appear on television these days advice investors to stay away from the markets, then why are they buying big time(?)

Any answers/guesses?

Sunday, May 28, 2006

Well, what a fortnight?

Some interesting articles to read:

1. Yen_carry_trades unwinding

2. Its a musical chair out there, Indian stocks v/s Chinese

3. Women flock to stock markets

4. And, the best for the last "Indian markets can decline to 6000-9000, says Marc Faber".

By the way, the last article is an interview with Marc Faber conducted by Jitendra Gupta. He is one of my colleagues from the 2001--03 MBA batch. He works with the Financial Express. All the best Jitendra. Great going.

Monday, May 22, 2006

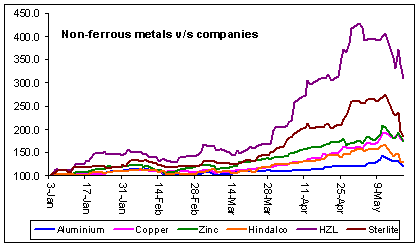

Non-ferrous commodities v/s companies; In hindsight ofcourse!

Sterlite Industries: -41.1%

Hindustan Zinc: -38.6%

National Aluminium: -29.9%

Hindalco: -27.4%

(source: www.nseindia.com)

In comparison, the decline in the respective non-ferrous metals was as follows:

Zinc: -15.0%

Aluminium: -16.9%

Copper: -11.6%

(source:www.lme.com, updated upto 22-May-06)

The decline in non-ferrous metal scrips seems too fast and too furious, isnt it? But have a look at the performance of these scrips (vis-a-vis the respective commodities) since January this year. The chart says it all. Non-ferrous metal scrips ran too quick and too high!

Where are these companies headed? I do not know. But a colleague (who looks at metals - ferrous and non-ferrous) tells me that Hindalco Industries is most undervalued, compared to its peers. This is on the back of a turnaround in the company's copper business, which incurred losses till the Dec'05 quarter, but is now into the black.

Friday, May 19, 2006

Who is selling big ? Institutions are not.

Total institutional activity turns out to be: FIIs + MFs = -1,304 crore (ie. -3,676 + 2,372).

Net sales of Rs.1,304 is too small an amount to result in a 13.5 per cent decline. Then why did the benchmark indices fall at such an alarming rate ? And more importantly, who is selling big, if not the institutions (taken in aggregate) ?

Any ideas/guesses ?

Thursday, May 18, 2006

Markets plunge by over six percent; Is this a beginning ?

Now lets look at their net investments so far. As per the data available from SEBI, following are the net investments for MFs during Jan-May 2006.

Jan: -1,172

Feb: - 246

Mar: 4,483

Apr: 3,121

May: 2,626 (so far)

Cash lying with the MFs (net of investments): 35,206 - 8,812 = Rs.26,394 crore.

Thus, even after investing over Rs.8.8k crore in the last three months, domestic MFs seem to be still sitting on mountains of cash. What does this mean for our markets ?

I think MFs are actively buying shares and taking advantage (?) of the FII offloading. I think they will remain net buyers for another 2-3 months. FIIs have been the culprits in the declines recorded in the last few days. Will this continue for long ? I think NOT.

MFs will increase their support, and FIIs (some hedge funds, is the market grapevine) are likely to turn positive numbers, or so I believe.

Moral of the story: If you've been smart enough (or rather lucky) to convert some of your holdings into cash recently, then start nibbling. And, if you are fully invested, remain so. Do not let a 7-8 per cent crash go bonkers. Instead, stay calm and remain invested. Markets will soon stabilise.

Happy Investing.

Saturday, May 06, 2006

Trouble with investing in growth stocks

I recently came across this nice (book review) article on "Problems of growth stock investing" on capitalideasonline. The book under review was Hedge Hogging by Barton Biggs.

Here's an excerpt -

Growth stock believers argue that you want to own stock in companies whose earnings and dividends are consistently increasing. What you pay for the shares of these companies is important, but not as crucial as correctly identifying true growth companies. By definition, these companies tend to have excellent managements, proprietary positions in businesses that are not particularly cyclically sensitive, and to be highly profitable.

Ideally, growth stock investors want to hold shares in great businesses, and they sell only when the business itself falters, not because the price of the shares has risen. Academics have proved that if you had perfect foresight and bought shares of the companies with the fastest earnings growth, regardless of valuations, over the long run you would outperform the S&P 500 by 11 percentage points a year, which is an immense amount.

The problem is that no one has perfect foresight. In fact we are all generally overconfident and overoptimistic about our skill in picking growth companies. Identifying growth ex ante is extremely difficult, and as noted previously, growth companies have, for one reason or another, a high propensity to fall from grace, in other words, to stop being growth companies. By the time you the investor can clearly identify a stock as a growth stock, it usually will already be valued accordingly. Therefore, you end up buying the expensive stocks of good companies.

--

A compelling argument for sure. After all how many of us would have invested in Pantaloon Retail India between 1992-2002 during which the company's mcap was less than Rs.30 crore. Fast forward to 2006, and its trading at a mcap of Rs.5,100 crore. I think the same holds true for IT stocks in mid-nineties or the breweries industry in all of last one and a half decade of stocks investing in India. Ofcourse, there would be an odd investor(s) who would have hit gold by investing such stocks. But, those are clearly the "outliers" in the whole galaxy of investors. So what should one do to hit one such gold mine over one's lifetime ? My personal opinion (greatly influenced by WB and BG) is as follows:

1. Identify good and sustainable businesses (ones whose products do not run the risk of vanishing like the pagers, type-writers, etc.)

2. Reasonably good management with some kind of track record.

3. Buy these companies when they are reasonably unknown, thereby buying them at cheap rates more often than not.

4. Last but the most important, hold them all for a life time.

Not all companies selected by the method above will turn into multi-baggers, but even if one does, returns on one's entire portfolio are likely to be fairly good. If 3-4 stocks turn multi-baggers, then well (!), one should contemplate writing yet another "How to Make Money by Investing in Stocks" and make even more money ;-)

Friday, April 28, 2006

SEBI better not let these scamsters go scot free this time - IPO Scam

In an interim order released last evening the SEBI said -

In the recent past while examining off-market transactions in the IPOs of Yes Bank Ltd. (‘YBL’) and Infrastructure Development Finance Company Limited (‘IDFC’), it came to the notice of SEBI that certain entities had cornered IPO shares reserved for retail applicants by making applications in the retail category through the medium of thousands of beneficiary accounts in the name of fictitious/benami entities with each of the application being of small value so as to be eligible for allotment under retail category. After the allotment, these fictitious/ benami allottees transferred these shares to their principals who in turn transferred the shares to their financiers. Most of these shares were sold immediately on listing.

The entire order can be downloaded from here.

SEBI pulled up some of the best known banks in the country, namely - HDFC Bank, IDBI Bank and ING Vyasa Bank. These banks are also banned from opening fresh demat accounts. So much for the clean image that these banks carry on their shoulders !!

However, I think the bigger problem is not these entities (ie. either pple like roopalben, karvy or the aforesaid banks), but the whole system of quotas (for eg. 25% for retail participants, 50% for institutional investors, etc.) in IPO allotment. I think there is great incentive for pple to apply for shares in IPO via multiple accounts (fictitious or otherwise). Even my 15-yr old cousin could comprehend the way out for non-allotment of shares during IPOs - put more applications. Multiple applications simply increase the probability of individuals getting some shares during the allotment process.

Possible solution (or is it ?)

What if we revamped our IPO process to something like what Google did last year, ie. can companies simply auction their shares without having to resort to any of the intermediaries and without having these quotas. They can be allowed to set a minimum price, but let mkt forces decide the final IPO price (instead of the weird book-building process with a tight price band).

Once the price is decided by the investors bidding for shares of a company, the allocation should be done on a pro-rata basis across-the-board. Further, large investors (QIBs or Institutional) be required to put up application monies upfront. Currently they are exempted from this. This system can (or rather I think it does) attract frivolous applications that can be used to artificially show higher demand. To summarise -

1.Shift the IPO process from a quota-based one to a pure auction process

2. Make allocations on a pro-rata basis

3. Let the market decide the final issue price, instead of the co. providing a small band (5-10%) which is really a mockery of the book-buliding and the price discovery process.

4. Make sure all entities pay application monies upfront, so as to avoid frivolous applications.

Saturday, April 22, 2006

Mutual funds sitting on mountains of cash

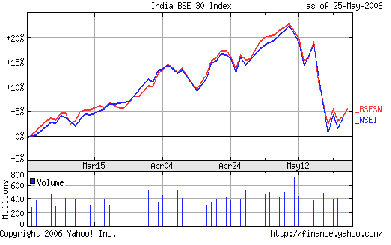

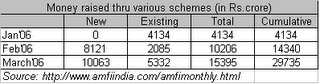

However, a look at the tables above indicate that mutual funds are still sitting on mountains of cash (to the extent of Rs.25,000 crore). Given that SEBI does not allow MFs to sit on cash for long, MFs are likely to make more investments (and much larger in size) over the next two months.

MFs are only a part of the overall equation. The other major player is the FII. They have been net sellers in April. Infact, between 10-20 April, they were net sellers to the tune of USD 700 million (Rs.3000 odd crore). Will FII continue to be net sellers is again something I do not really know. But, given the response to Reliance Petroleum's initial public offering, one can conclude that the current trend of net sales by FIIs is most likely a temporary one.

Moral of the story - Stay Invested in equities, atleast for now !!

Wednesday, April 19, 2006

Have you been taking tips from message boards ?

A "message board" is an internet forum for holding discussions, allowing people to post messages and comment on other messages. Not just this, websites these days offer forums dedicated to topics. Famous among these topics is -- stocks and stock markets. Hundreds and thousands of some smart and some not so smart investors/speculators/traders are actively participating in these.

While participating and holding discussions is ok. What one needs to worry about is whether the common man is taking investing decisions based on the stock ideas/tips/hot stocks posted on these forums. Most of the discussions taking place on these internet forums can be used to cheat investors since there is a big question mark over the identity of the person on the other side of the forum.

A 15 year old kid was caught doing a similar act in the US in 2000. He was later on fined by the SEC for over USD 200,000. Here is an excerpt of a news article on the same -

On Sept. 20, 2000, the SEC settled its case against a 15-year-old high-school student named Jonathan Lebed. The S.E.C.'s news release explained that Jonathan -- the first minor ever to face proceedings for stock-market fraud -- had used the Internet to promote stocks from his bedroom in the northern New Jersey suburb of Cedar Grove. Armed only with accounts at A.O.L. and E*Trade, the kid had bought stock and then, "using multiple fictitious names," posted hundreds of messages on Yahoo Finance message boards recommending that stock to others.

He had done this 11 times between September 1999 and February 2000, the S.E.C. said, each time triggering chaos in the stock market. The average daily trading volume of the small companies he dealt in was about 60,000 shares; on the days he posted his messages, volume soared to more than a million shares. More to the point, he had made money. Between September 1999 and February 2000, his smallest one-day gain was $12,000. His biggest was $74,000. Now the kid had agreed to hand over his illicit gains, plus interest, which came to $285,000.

Ranjit thanks for pointing me to this article.

Saturday, April 15, 2006

New addition to the blog - ppt on p/e ratio and buying RCVL shares

Btw, markets corrected sharply last week, falling by over 600 points from the highs of the week. It is no surprise that FIIs led the decline. They not only sold shares worth over Rs.1000 crore in the cash market but went short in the derivatives market by over Rs.5,000-6,000 crore. I think this a bull market correction, that is painful, but is likely to be short in nature. I think FIIs will soon turn out positive figures. Furthermore, domestic mutual funds are sitting on mountains of cash, raised in the last two months ended March 2006. See here and here.

So if the correction continues during the next week, I for one will be looking to add a few stocks to my portfolio.

One of the stocks that I recently purchased is Reliance Communication Ventures (RCVL). The company seems undervalued at current levels given that it has some 18 million mobile subscribers and is yet quoting less than half of Bharti Televentures value (of over Rs.70,000 crore).

Here are how the numbers stack up -

- Mobile subscribers: RCVL and BTVL - 18 million each

- ARPU: RCVL -Rs.412 per month, BTVL - Rs.470 per month

- Avg. minutes per user: RCVL - 547 mins, BTVL - 411 mins

- Mcap (as of 13 Apr '06): RCVL - Rs.33k crore, BTVL - Rs.71k crore

Points to think -

- Each of the two companies is adding around a million customers every month

- Given current rate, the two will have over 30 million customers by the end of current fiscal and some 38-40 million by FY08.

- Given the current ARPUs, expected revenues from just the mobile business are likely to be around Rs.20,000 crore. Adding another Rs.5-7,000 crore (a conservative estimate) from RCVL and BTVL's other businesses (such as broadband, landline, ILD, etc.), total revenues are expected to be around Rs.25,000-27,000 crore.

- PAT margin of 20% (which is what BTVL currently earns and I expect RCVL would earn the by end of this fiscal) would yield a NPAT of Rs.5000-5400 crore. A discouting of 15 times for a fast growing business such as telecom should result in these companies attracting valuations of close to Rs.75-80,000 crore.

- BTVL (Rs.71,000 crore) is currently trading close to this, whereas RCVL is trading at a significant discount (at Rs.33,000 crore).

Conclusion - RCVL offers good upside with little risk on the downside.

Tuesday, April 11, 2006

Stock markets are booming and so is the art of stock picking/investing ?

Just the other day an office colleague of mine was talking confidently about the hottest IPO in town - Reliance Petroleum. While the company is offering its shares at Rs.62 per share, my friend here claims that it will touch Rs.300 per share on the day of its listing. Well what exactly does a price of Rs.300 per share mean for this company.....read on.

Reliance Petroleum is raising funds to "set up" a world scale petroleum refinery in the state of Gujarat. At Rs.62 per share, it is valued at around Rs.28,000 crore, that for a company which is still to lay the foundation for its refinery, let alone earning any revenues. And if at Rs.62 per share it is valued at Rs.28,000 crore, Rs.300 per share would fetch it a value of a mindnumbing Rs.135,000 crore. This is higher than its parent co. Reliance Industries. Well, so much for a booming stock market and its effect on investor psyche. Beware, speed breakers ahead !!

In another incident a colleague was happy to share his investment made this week in a new mutual fund scheme. This after he stayed away from the markets for all this while thinking it was risky to invest his savings (read hard earned money) into stock markets. While it is nice to know that here was a retail investor who is taking a safer route of investing into stock markets through a mutual fund (and a reputed one at that)....but what one needs to wonder is whether - is this the right time to make fresh investments ? May be or maybe not.

Students of behavioral finance would say that such incidents mark the beginning of an end !

Btw, listed below are a few investing rulez that my friend (Tariq) and I follow. We've learnt these over the last 2-21/2 years of stocks investing experience. Hope you find'em useful in these markets -

1. MORE JEWS (or MARWARI's in India's case) LOST THEIR SHIRTS on the WALL STREET AVERAGING in a falling market than those affected by the Great Depression.

NEVER AVERAGE.

2. Always buy stocks that offer a good MARGIN OF SAFETY.

Margin of safety is the difference between the intrinsic value of a stock (i.e. value based on stock valuation and what the company is actually worth) and the price that the market sets on a stock (i.e. stock price is a matter of market participants' opinions and is different from the intrinsic value). Buying stocks with healthy MoS provides a higher probability of earning returns.

3. It is inseparable from Human Nature; To Hope and To Fear. The successful trader/investor/speculator has to fight these two deep-seated instincts. Instead of hoping he must fear; instead of fearing he must hope. He must hope that his loss may develop into a much bigger loss; and hope that his profit may become a big profit.

IT IS ABSLOUTELY WRONG TO GAMBLE IN STOCKS THE WAY THE AVERAGE MAN DOES !

4. What does a man do when he sets out to make the stock market pay for a sudden need ?

He not only just hopes. He gambles. To begin with, he is after an immediate profit. He cannot afford to wait. Which means, he foolishly begins to believe that - THE MARKET MUST BE NICE TO HIM AT ONCE, IF AT ALL.

NEVER GO TO STOCK MARKETS 'HOPING' YOU WILL MAKE MONEY, YOU ARE BETTER OFF BETTING ON HORSES THAT WAY.

The last two quotes are from the book - Reminiscences of a Stock Operator by Edwin Lefevre. It is a biography on the greatest stock trader of our lifetime - Jesse Livermore. It is a must read for anyone looking to invest in stocks.

Saturday, April 01, 2006

Holding companies, interesting investment plays

In India, such holding companies are valueed at deep discount to their real market value. The discount is as high as 65-70 per cent. But, if one were to monitor the twins (ie. the market value of the holding company vis-a-vis the market value of its holdings) there can be a case for an arbitrage play.

The arbitrage should, however, be done with the assumption that the "upper limit" for the holding company is around 30-35 per cent of the mkt value of the underlying holdings. Thus, any deviation from this on the lower side can be used as an opportunity. I've listed down example of two such cases in which i've been trading in the last one year, with reasonably good success.

Case 1 - Morarka Finance.

The company is a holding company of Dwarikesh Sugar Industries Ltd (DSIL). It holds 2,348,818 shares or a 15.1 per cent stake in DSIL. At current prices (Rs.257 as on 31-Mar-06), DSIL is valued at Rs.400 crore. Value of Morarka Finance' holding in DSIL thus comes to around Rs.60 crore (15% of Rs.400 crore). Given that holding companies in India are valued at 30-35 per cent of their true market value, Morarka Finance should be valued at Rs.18-20 crore. But, at Rs.30.5 per share, Morarka Finance's mcap is only Rs.13.5 crore. Morarka Finance shares therefore seem to be undervalued to the extent of 33-48 per cent.

Disclosure: I've an open position in Morarka Finance (bought day before yesterday @ Rs.30.5). I intend to sell it once the arbitrage is no longer available. ie, when, - 0.3 * Value of Morarka Finance' holding = Mcap of Morarka Finance.

Case 2: SRF Polymers.

SRF Polymers is a holding company of SRF Ltd. The company holds 36.5% stake in SRF directly and through its 100% subsidiary - SRF Polymer Investments Pvt. Ltd. At Rs.331 per share, market capitalisation of SRF Ltd. comes to Rs.2,142 crore. Value of SRF Polymers holding thus comes to around Rs.781 crore. Thus, the approximate the market value of SRF Polymers should be in the range of Rs.234-274 crore (30-35% of true market value). But, at current prices (Rs.214), SRF polymer shares are quoting at a mcap of Rs.140 crore. Clearly, there seems to be an upside of 67-92 per cent from current levels.

Disclosure: I do not hold any shares in SRF Polymers. I tried buying them in the last two trading sessions, but unfortunately the damn thing was stuck at the 5% upper circuit. Hope to get in on Monday.

There are many such other companies listed on the bourses. However, I've restricted myself to these two. Some of the other companies include - Zuari Industries, Vindhya Telelinks, UB Holdings, Nahar group companies, Winsome Textiles Industries, Shree Rajasthan Syntex and Shree Rajasthan Texchem, etc. Investors are advised to do a thorough study before taking any investment calls made out on this or for that matter any other blog.

Happy investing.