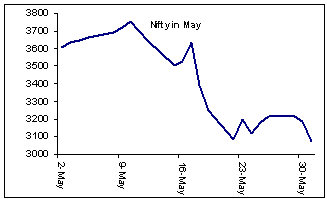

Yet, the benchmark Nifty ended the month with a decline of 14.8 per cent. From the high of the month, the index ended 18.2 per cent lower.

Some questions:

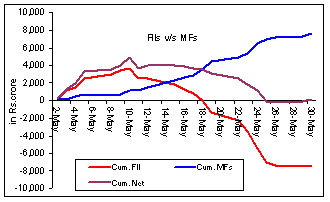

1.Why should the markets decline as much as they did, when two of the major players in the market (FIIs and MFs) simply swap holdings, as indicated by their transaction figures(?)

2.Besides, since institutional activity remained marginally positive (net-net, ie.), who sold big(?)

3.Most of the fund managers who appear on television these days advice investors to stay away from the markets, then why are they buying big time(?)

Any answers/guesses?

1 comment:

your questions r good ,but iam new one to this proffesion.i think indian market is strong enough to revertback soon, i.e one month.because india is developing country and it needs lot of business,then only we can reach and cross the advanced countries.

Post a Comment