Some interesting articles to read:

1. Yen_carry_trades unwinding

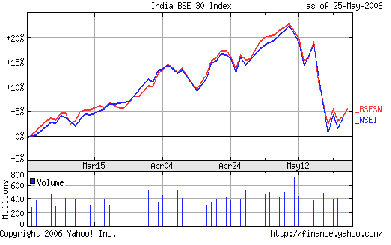

2. Its a musical chair out there, Indian stocks v/s Chinese

3. Women flock to stock markets

4. And, the best for the last "Indian markets can decline to 6000-9000, says Marc Faber".

By the way, the last article is an interview with Marc Faber conducted by Jitendra Gupta. He is one of my colleagues from the 2001--03 MBA batch. He works with the Financial Express. All the best Jitendra. Great going.

2 comments:

Hello ravi,

The interview with faber is really a scary one,already i have levelled out in this fall i.e no profit no loss in the last three months(that was the time when i started to invest in the stock markets).I was sitting over a profit of 30000 till a fortnight back and then suddenly lost 75% of my gains.And when faber predicts the market to go in between 6-9000 he would have a reason for it.

What strategy should be employed yaar.Should we reduce our holdings or should we buy more.Nothing is clear.There are so many contradictory views.What do you say.

If you are positive do mention some value picks from a small time perspective.

Thanks in advance,

Anil.

Anil: Ideally when things turn as hot as the were a fortnight back, one should increase cash holdings by booking some of the profits. I converted 25% of my portfolio into cash just a few days before the crash. But, unfortunately for me, I could not resist and bought into a tip from a friend(s). BAD MOVE, not matter how reliable your friends, brokers or relatives are.

I think its best to sit on cash holdings (say around 25-30%) for sometime, if you are not too confident about the prospects of the stocks (both business wise and valuations wise) that you own.

But if you are confident about the stocks that you own then might as well sit tight.

Sorry, Anil I dont usually punt on the short-term, so cant give you any "tips" on that front.

Happy investing,

Ravi.

Post a Comment