The efficient market hypothesis as defined on Wikipedia is as follows:

In finance, the efficient market hypothesis (EMH) asserts that financial markets are "efficient", or that prices on traded assets, e.g. stocks, bonds, or property, already reflect all known information and therefore are unbiased in the sense that they reflect the collective beliefs of all investors about future prospects. The efficient market hypothesis implies that it is not possible to consistently outperform the market — appropriately adjusted for risk — by using any information that the market already knows, except through luck or obtaining and trading on inside information. Information or news in the EMH is defined as anything that may affect stock prices that is unknowable in the present and thus appears randomly in the future. This random information will be the cause of future stock price changes.

There are three versions to this hyposthesis:

1). The Weak form: No excess returns can be earned by using investment strategies based on historical share prices or other financial data. Conclusion - Technical analysis cannot earn excess returns.

2). The semi-weak form: Share prices adjust within an arbitrarily small but finite amount of time and in an unbiased fashion to publicly available new information, so that no excess returns can be earned by trading on that information. Conclusion - Fundamental analysis will bear no fruit.

3). The strong-form: Share prices reflect all information (inside or otherwise) and no one can earn excess returns. Conclusion - Even insiders cannot earn excess returns.

The entire article on Wikipedia rightly points to the fact that investors need not be rational for the EMH to hold or else how can one explain the excesses of the IT boom and many such booms on the yesteryears.

But if looked closely one can say that the EMH principle actually holds because market players are irrational or rather inefficient in their actions. Which means markets on the whole remain efficient so long as investors are inefficient/irrational. And, if most investors turned to index funds (believing into the efficient market hypothesis), the markets may no longer remain efficient and sustained outperformance can be achieved............hmm.......interesting (looking for more wisdom on this?)

Tuesday, June 27, 2006

Sunday, June 11, 2006

Take a holiday, says Marc Faber

Marc Faber had recently predicted that Indian equities alongwith a host of other emerging markets and commodities were over-valued and are likely to correct by as much as 30 per cent. Well, he was bang on with his prediction. Equities and commodities across-the-globe did witnessed significant selling pressure in the last one month. In India, both the Sensex and the Nifty are down by 25 per cent each. Some of the stocks in the mid-cap pack witnessed a sharper decline (around 50-70 per cent).

In his investment report for June 2006, Marc Faber recommends selling investments at any pull-back rallies during the next few months. He expects a further 30 per cent slide in many of the emerging markets. Read the full report here.

Btw, the decline did throw open some good buying opportunities on Thursday. I picked up CREW BOS Products and Reliance Comm. Ventures Ltd. They went up 20% each on Friday. I think I am going to be trading mostly (something I dont do....!!) in these markets to take advantage of extreme reactions.

Trivia: Will markets resume their journey downsouth or will it consolidate next week or will it claw-back above the 10,000 mark?

In his investment report for June 2006, Marc Faber recommends selling investments at any pull-back rallies during the next few months. He expects a further 30 per cent slide in many of the emerging markets. Read the full report here.

Btw, the decline did throw open some good buying opportunities on Thursday. I picked up CREW BOS Products and Reliance Comm. Ventures Ltd. They went up 20% each on Friday. I think I am going to be trading mostly (something I dont do....!!) in these markets to take advantage of extreme reactions.

Trivia: Will markets resume their journey downsouth or will it consolidate next week or will it claw-back above the 10,000 mark?

Thursday, June 01, 2006

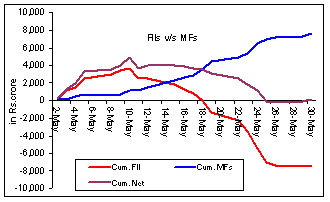

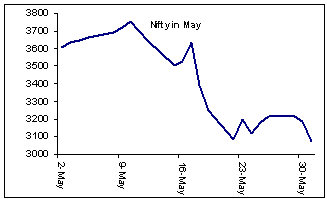

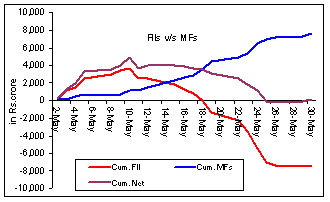

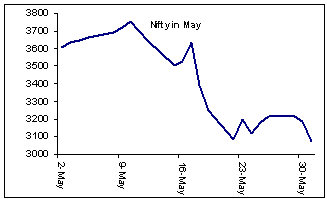

FII investments v/s MF investments and Nifty in May(?)

Interesting charts - Cumulative net investments by two major investor categories - FIIs and Mutual Funds amounted to a positive Rs.157 crore (surprise, surprise!!). FIIs : -7,415 crore and MFs: +7,573 crore.

Yet, the benchmark Nifty ended the month with a decline of 14.8 per cent. From the high of the month, the index ended 18.2 per cent lower.

Some questions:

1.Why should the markets decline as much as they did, when two of the major players in the market (FIIs and MFs) simply swap holdings, as indicated by their transaction figures(?)

2.Besides, since institutional activity remained marginally positive (net-net, ie.), who sold big(?)

3.Most of the fund managers who appear on television these days advice investors to stay away from the markets, then why are they buying big time(?)

Any answers/guesses?

Yet, the benchmark Nifty ended the month with a decline of 14.8 per cent. From the high of the month, the index ended 18.2 per cent lower.

Some questions:

1.Why should the markets decline as much as they did, when two of the major players in the market (FIIs and MFs) simply swap holdings, as indicated by their transaction figures(?)

2.Besides, since institutional activity remained marginally positive (net-net, ie.), who sold big(?)

3.Most of the fund managers who appear on television these days advice investors to stay away from the markets, then why are they buying big time(?)

Any answers/guesses?

Subscribe to:

Comments (Atom)