Sterlite Industries: -41.1%

Hindustan Zinc: -38.6%

National Aluminium: -29.9%

Hindalco: -27.4%

(source: www.nseindia.com)

In comparison, the decline in the respective non-ferrous metals was as follows:

Zinc: -15.0%

Aluminium: -16.9%

Copper: -11.6%

(source:www.lme.com, updated upto 22-May-06)

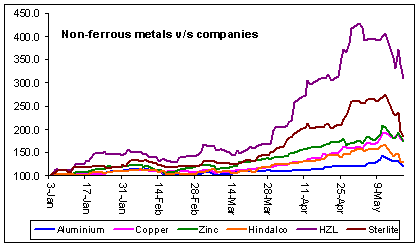

The decline in non-ferrous metal scrips seems too fast and too furious, isnt it? But have a look at the performance of these scrips (vis-a-vis the respective commodities) since January this year. The chart says it all. Non-ferrous metal scrips ran too quick and too high!

Where are these companies headed? I do not know. But a colleague (who looks at metals - ferrous and non-ferrous) tells me that Hindalco Industries is most undervalued, compared to its peers. This is on the back of a turnaround in the company's copper business, which incurred losses till the Dec'05 quarter, but is now into the black.

3 comments:

Its normal for commodity stocks to rise/fall faster than the underlying commodity.This is bcoz of operating leverage.

This can be observed in all commodities-cement,sugar,metals and across all markets...witness the brutal sell-off in gold mining shares in the US recently

% of copper revenues as compared to overall revenues of Hindalco is not significant.Buying Hindalco at these levels is like catching a falling knife...

Nitin: Copper accounted for over 50% of Hindalco's total revenues during the quarter ended March 2006. However, in terms of profits it amounted to only around 16 odd per cent. The copper division reported profits of Rs.120 crore during the March06 quarter as compared to Rs.700 odd crore from the aluminium biz. Performance of the copper division will further improve in the ensuing quarters.

But yes you are right. Buying a stock in a falling market is a poor strategy. I was once told by a colleague that "More Jews lost their shirts averaging in a falling market, than those affected by the Nazis".

Moral of the story: Wait for things to cool off, both in the commodity market and the stock market. Till then Cash is King, ofcourse provided we are left with any ;-).

Nice joke about the jews:)

Mea Culpa on the copper front...was looking only at the bottomline not the revenues.

Have a slightly diff moral of the story:Short the rupee while the commodity and equity markets are in chaos:)

Post a Comment