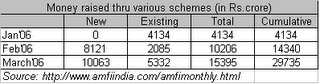

However, a look at the tables above indicate that mutual funds are still sitting on mountains of cash (to the extent of Rs.25,000 crore). Given that SEBI does not allow MFs to sit on cash for long, MFs are likely to make more investments (and much larger in size) over the next two months.

MFs are only a part of the overall equation. The other major player is the FII. They have been net sellers in April. Infact, between 10-20 April, they were net sellers to the tune of USD 700 million (Rs.3000 odd crore). Will FII continue to be net sellers is again something I do not really know. But, given the response to Reliance Petroleum's initial public offering, one can conclude that the current trend of net sales by FIIs is most likely a temporary one.

Moral of the story - Stay Invested in equities, atleast for now !!

2 comments:

It will be interesting to see the Mutual Fund figures after 3 months...considering that there is a lot of fund "flipping" going on

One things for sure...investing in these funds is not the best way to enter the market at these levels

Nitin: I agree. These new funds are surely not likely to outperform over the next few months, unless ofcourse mkts are headed to something like 15k plus (on the Sensex).

I think I will closely watching the FIIs while MFs make large investments over the next two months. If they choose to remain net buyers then we are looking at some seriously large amounts of money (FIIs + MFs) coming in at current levels. Maybe be we have decidely entered the third phase of bull markets, the greed phase (or the beginning of the end).

BTW: the SEBI IPO scam unearthed today is likely to pull mkts down tomorrow and maybe will offer greater opportunities to the MFs to deploy their funds.

Exciting days ahead !!

Post a Comment