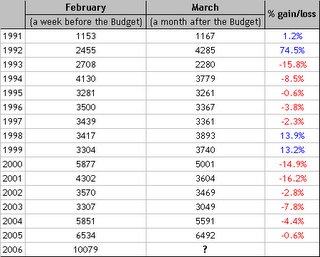

So how does one play this sharp rise in volatility ? I'm no expert in the derivatives (still learning the ropes there). But nevertheless, here is my half-bit. One should look to sell (write) out_of_the_money call options as this point in time. This is purely based on my view that the markets may decline post the Budget. I've history on my side too. The chart given below indicates the same. A month after the announcement of the Union Budget, the benchmark indices (BSE Sensex and NSE Nifty) closed below the pre-Budget levels on eight of the last ten occasions. Will the same happen this year too, who knows ?

But, given the upcoming elections in the Left-dominated states (which may restrict GoI to undertake broader economic reforms during UB '06-07), the onset of the bird-flu disease in India, increased volatility in most of the emerging markets, a sharp slowdown in the growth of the Index of Industrial Production and a muted growth in exports, I feel a little wary of engaging fresh investments in the market. Writing out-of-the-money calls and increasing the share of cash in one's overall portfolio seems to be a safer bet at this point in time.

Source: http://www.bseindia.com/histdata/hindices.asp

3 comments:

This year, Indian stock market has behaved a bit abnormally. Bucking the trend in last three consecutive years, the market has remained firm during the prebudget period largely on account of mutual fund money chasing fundamentally storng stocks and big baits of a few FIIs on Indian GDP growth story. This abnormality may continue even after the budget and we may continue to see a firm trend in the stock market!

Ranjit,

Looks like you got it right. Both Sensex and Nifty seem to be headed for the orbit....!!

Hi Ravi, you must visit this link...:--)

http://galatime.com/?p=52

Post a Comment