The new years party was great. But, it was very tiring as well. So i was lazing around (rather sleeping) for most of the day. By evening, i thought i was too bored to be sleeping. After 10 mins walk, i thought let me find out - whats in store for 2006 ? Where does one invest - equities, commodities or bonds ?

I personally do not invest in commodites or bonds. So it will be equities for me. I thought, let me see what the world thinks ? But it is next to impossible to figure what the world thinks, so i thought lets see if i can get something on Google.

After wondering for a while, i decided to do the following. Search in news.google.com. I did three studies -

1. What to invest in ?

a). equities, b).commodities or c).bonds.

Result - Commodities (with a Bull/Bear ratio - 3.5 times).

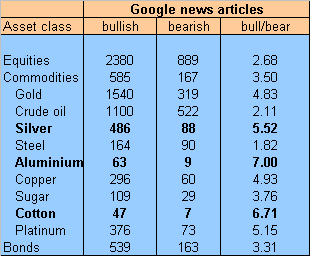

2. If commodities, then which ones ?

Result - Aluminium (Bull/Bear ratio - 7.0 times), Cotton (6.7 times) and Silver (5.5 times).

3. If one has to invest in equities, then which countries ?

Result - India (Bull/Bear ratio - 6.1 times), Europe (6.01 times) and Korea (5.9 times).

These are my predictions after looking at the data from Google news search. The method used here was fairly simple - search for news items with the following search words - asset/country + bullish/bearish.

The sample for equities would look something like equities + bullish and equities + bearish. The bull to bear ratio is based on the number of news items that contained the respective search words. So typically an article which contained any of these two words at a time would be qualified as a view.

Following are the output tables -

(% returns data was sourced from www.msci.com)

No comments:

Post a Comment