The global airline industry incurred a loss of USD 6 billion in 2005. Since the year 2001, the industry's total losses amount to a whopping USD 42 billion. This industry has a long history of incurring losses, with no competition whatsoever. It is expected to post a loss of USD 4.3 billion in 2006, says the International Air Transport Association.

Economics teaches us that intense competition leads to zero-economic profits. But, companies are expected to earn reasonable returns on their capital, just to stay in business. Marginal cost price = selling price is how we define competitive markets.

But, the airline industry simply amazes me.

Airlines are a form of transportation, just like railways and automobiles. But, its different. It has far more advantages over the former two. It reduces travel time substantially, provides safer travel (road travel is more dangerous. Read this in Freakonomics) and gives you great comfort. Yet, it makes losses. Whereas railways and automobiles earn decent returns on their capital. Atleast, automobiles as a industry does.

And, so do other fiercely competitive industries such as financial services, telecom and consumer goods.

So the question is - Why do airline companies continue to fly ?

Wednesday, March 22, 2006

Sunday, March 19, 2006

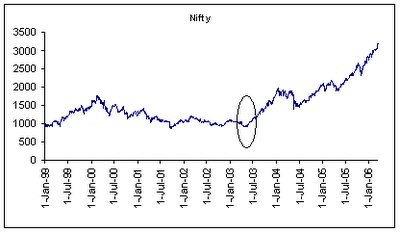

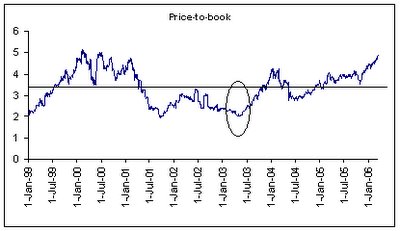

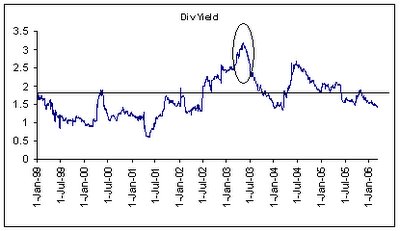

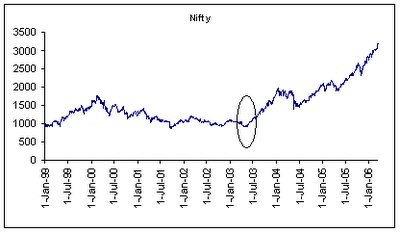

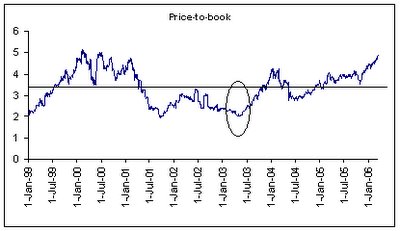

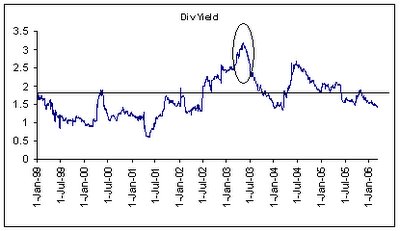

Are Indian market valuations hitting upper limits ? A historical perspective.

Indian markets have been on a roll since mid-2003, yielding a return of 250 per cent . India as a stock (in mid-2003) was trading more like a "cigar butt" (as Charlie Munger would've called a deep-value stock). The Nifty index was then trading at a p/e of 12.5 times and a price-to-book ratio of 2.5 times. Dividend yield too was at around 3%. These were levels not seen in many years. That period was the best for making investments in good companies with robust business models. The list would include auto companies, capital goods, PSUs (including banks), etc. Followers of Benjamin Graham are always in the look for such periods of stock market history.

But, after a 250 per cent accent, how do markets look today ? Where do the key valuation parameters (p/e, p/b and div. yield) stand today and what to they indicate ? The following charts tell the story -

Source: www.nseindia.com/content/indices/ind_statistics.htm

Of the three indicators, two (p/b and yield) clearly indicate stretched valuations. However, at 19 times p/e ratio remains modest, by historical standards. But, a further rise in stock prices will have to be supported by an earnings growth of 20% +. Will corporate India record such a growth ? If yes, then one needs to look for sectors that will lead this growth. Does anyone have a view on this ?

PS: The lines drawn in the last three charts represent six year average for the valuation ratios. For the p/e ratio it is 17 times, average for p/b and dividend yield is 3.3 times and 1.7%, respectively.

But, after a 250 per cent accent, how do markets look today ? Where do the key valuation parameters (p/e, p/b and div. yield) stand today and what to they indicate ? The following charts tell the story -

Source: www.nseindia.com/content/indices/ind_statistics.htm

Of the three indicators, two (p/b and yield) clearly indicate stretched valuations. However, at 19 times p/e ratio remains modest, by historical standards. But, a further rise in stock prices will have to be supported by an earnings growth of 20% +. Will corporate India record such a growth ? If yes, then one needs to look for sectors that will lead this growth. Does anyone have a view on this ?

PS: The lines drawn in the last three charts represent six year average for the valuation ratios. For the p/e ratio it is 17 times, average for p/b and dividend yield is 3.3 times and 1.7%, respectively.

Wednesday, March 15, 2006

FIIs short in the F&O, but remain net buyers in the cash market ?

FIIs have been net sellers in the derivatives segment since the beginning of this month, more so in the stock futures segment. Net sales in this segment (as of 13-Mar-06) amounted to Rs.2,114 crore. However, they remain net buyers in the cash segment. What does this indicate ?

To me this indicates the following -

1). FIIs remain bullish on Indian markets, hence the large net long positions in the cash market.

2). They, however, are unsure of the same in the short term, and are therefore hedging their positions in the derivatives market. If markets were to witness a sharp decline, positions in the derivatives market would ensure that the long positions in the cash market are maintained, without any sharp losses. This does seem like a narrow view and hedge funds or how my boss calls them "the water funds" essentially invest with a short term horizon indeed.

If the above is true then are we looking at a correction towards the end of expiry this month ?

If the above is true then are we looking at a correction towards the end of expiry this month ?

To me this indicates the following -

1). FIIs remain bullish on Indian markets, hence the large net long positions in the cash market.

2). They, however, are unsure of the same in the short term, and are therefore hedging their positions in the derivatives market. If markets were to witness a sharp decline, positions in the derivatives market would ensure that the long positions in the cash market are maintained, without any sharp losses. This does seem like a narrow view and hedge funds or how my boss calls them "the water funds" essentially invest with a short term horizon indeed.

If the above is true then are we looking at a correction towards the end of expiry this month ?

If the above is true then are we looking at a correction towards the end of expiry this month ?

Tuesday, March 14, 2006

How to minimise investment returns (WB's letter to shareholders continues..)

This bit (on frictional costs and how they lower investment returns) in Berkshire's annual letter to shareholders, deserved a special mention, hence a separate note on the same. Here is the excerpt -

Over the last century, American Businesses did extraordinarily well and investors rode the wave of their prosperity. Businesses continue to do well. But now shareholders, through a series of self-inflicted wounds, are in a major way cutting the returns they will realise from their investments.

The explanation of how this is happening begins with a fundamental truth: With unimportant exceptions, such as bankruptcies in which some of a company's losses are borne by creditors, the most that owners in aggregate can earn between now and Judgement Day is what their businesses in aggregate earn. True, by buying and selling that is clever or lucky, investor A may take more than his share of the pie at the expense of investor B. And, yes, all investors feel richer when stocks soar. But, an owner can exit only by having someone take his place. If one investor sells high, another must buy high. For owners as a whole, there is simply no magic - no shower of money from outer space - that will enable them to extract wealth from their companies beyond that created by the companies themselves.

Indeed, owners must earn less than their businesses earn because of "frictional" costs. And thats my point: These costs are now being incurred in amounts that will cause shareholders to earn far less than they historically have.

To understand how this toll has ballooned, imagine for a moment that all American corporations are, and always will be, owned by a single family. We'll call them the Gotrocks. After paying taxes on dividends, this family - generation after generation - becomes richer by the aggregate amount earned by its companies. Today that amount is about $700 billion annually. Naturally, the family spends some of these dollars. But the portion it saves steadily compounds for its benefit. In the Gotrocks household everyone grows wealthier at the same pace, and all is harmonious.

But lets assume that a few fast-talking Helpers approach the family and persuade each of its members to try to outsmart his relatives by buying certain of their holdings and selling them certain others. The Helpers - for a fee, of course - oblingingly agree to handle these transactions. The Gotrocks still own all of corporate America; the trades just rearrange who owns what. So tha family's annual gain is wealth diminishes, equaling the earnings of American business minus commissions paid. The more that family members trade, the smaller their share of the pie and the larger the slice received by the Helpers. This fact is not lost upon these broker-Helpers: Activity is their friend and, in a wide variety of ways, they urge on it.

After a while, most of the family members realise that they are not doing so well at this new "beat-my-brother" game. Enter another set of Helpers. These newcomers explain to each member of the Gotrocks clan that by himself he'll never outsmart the rest of the family. The suggested cure: "Hire a manager - yes, us - and get the job done professionally." These manager-Helpers continue to use the broker-Helpers to execute trades; the managers may even increase their activity so as to permit the brokers to prosper still more. Overall, the bigger the slice of the pie now goes to the two classes of Helpers.

The family's disppointment grows. Each of its members is now employing professionals. Yet overall, the group's finances have taken a turn for the worse. The solution ? More help, ofcourse.

It arrives in the form of financial planners and institutional consultants, who weigh in to advise the Gotrocks on selecting manager-Helpers. The befuddled family welcomes this assistance. By now its members know they can pick neither the right stocks nor the right stock pickers. Why, one might ask, should they expect success in picking the right consultant ? But this question does not occur to the Gotrocks, and the consultant-Helpers certainly don't suggest it to them.

The Gotrocks, now supporting three classes of expensive Helpers, find that their results get worse, and they sink into despair. But just as hope seems lost, a fourth group - we'll call them the hyper-Helpers - appears. These friendly folk explain to the Gotrocks that their unsatisfactory results are occuring because the existing Helpers - brokers, managers, consultants - are not sufficiently motivated and are simply going through motions. "What," the new Helpers ask, "can you expect from such a bunch of zombies?"

The new arrivals offer a breathteakingly simple solution: Pay more money. Brimming with self-confidence, the hyper-Helpers assert that huge contingent payments - in addition to stiff fixed fees - are what each family member must fork over in order to really outmaneuver his relatives.

The more observant members of the family see that some of the hyper-Helpers are really just manager-Helpers wearing new uniforms, bearing swen-on sexy names like HEDGE FUND or PRIVATE EQUITY. The new Helpers, however, assure the Gotrocks that this change of clothing is all-important, bestowing on its wearers magical powers similar to those acquired by mild-mannered Clark Kent when he changed into his Superman costume. Calmed by this explanation, the family decides to pay up.

And that's where we are today: A record portion of the earnings that would go in their entirety to owners - if they all just stayedd in their rocking chairs - is now going to a swelling army of Helpers. Particularly expensive is the recent pandemic (epidemic) of profit arrangements under which Helpers receive large portions of the winnings when they are smart or lucky, and leave family members with all of the losses - and large fixed fees to boot - when the Helpers are dumb or unlucky (or occassionally crooked).

A sufficient number of arrangements like this - heads, the Helper takes much of the winnings: tails, the Gotrocks lose and pay dearly for the privilege of doing so - may take it more accurate to call the family the Hadrocks. Today, in fact, the family's frictional costs of all sorts may well amount to 20% of the earnings of American business. In other words, the burden of paying Helpers may cause American equity investors, overall, to earn only 80% or so of what would earn if they just sat still and listened to no one.

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of a genius. But Sir Isaac's talents didn't extend to investing: He lost a bundle in the South Sea Bubble, explaining later, "I can calculate the movement of stars, but not the madness of men." If he had not been traumatised by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

You can download the "annual letter to shareholders for 2005" from here -

http://www.berkshirehathaway.com/letters/2005ltr.pdf

Over the last century, American Businesses did extraordinarily well and investors rode the wave of their prosperity. Businesses continue to do well. But now shareholders, through a series of self-inflicted wounds, are in a major way cutting the returns they will realise from their investments.

The explanation of how this is happening begins with a fundamental truth: With unimportant exceptions, such as bankruptcies in which some of a company's losses are borne by creditors, the most that owners in aggregate can earn between now and Judgement Day is what their businesses in aggregate earn. True, by buying and selling that is clever or lucky, investor A may take more than his share of the pie at the expense of investor B. And, yes, all investors feel richer when stocks soar. But, an owner can exit only by having someone take his place. If one investor sells high, another must buy high. For owners as a whole, there is simply no magic - no shower of money from outer space - that will enable them to extract wealth from their companies beyond that created by the companies themselves.

Indeed, owners must earn less than their businesses earn because of "frictional" costs. And thats my point: These costs are now being incurred in amounts that will cause shareholders to earn far less than they historically have.

To understand how this toll has ballooned, imagine for a moment that all American corporations are, and always will be, owned by a single family. We'll call them the Gotrocks. After paying taxes on dividends, this family - generation after generation - becomes richer by the aggregate amount earned by its companies. Today that amount is about $700 billion annually. Naturally, the family spends some of these dollars. But the portion it saves steadily compounds for its benefit. In the Gotrocks household everyone grows wealthier at the same pace, and all is harmonious.

But lets assume that a few fast-talking Helpers approach the family and persuade each of its members to try to outsmart his relatives by buying certain of their holdings and selling them certain others. The Helpers - for a fee, of course - oblingingly agree to handle these transactions. The Gotrocks still own all of corporate America; the trades just rearrange who owns what. So tha family's annual gain is wealth diminishes, equaling the earnings of American business minus commissions paid. The more that family members trade, the smaller their share of the pie and the larger the slice received by the Helpers. This fact is not lost upon these broker-Helpers: Activity is their friend and, in a wide variety of ways, they urge on it.

After a while, most of the family members realise that they are not doing so well at this new "beat-my-brother" game. Enter another set of Helpers. These newcomers explain to each member of the Gotrocks clan that by himself he'll never outsmart the rest of the family. The suggested cure: "Hire a manager - yes, us - and get the job done professionally." These manager-Helpers continue to use the broker-Helpers to execute trades; the managers may even increase their activity so as to permit the brokers to prosper still more. Overall, the bigger the slice of the pie now goes to the two classes of Helpers.

The family's disppointment grows. Each of its members is now employing professionals. Yet overall, the group's finances have taken a turn for the worse. The solution ? More help, ofcourse.

It arrives in the form of financial planners and institutional consultants, who weigh in to advise the Gotrocks on selecting manager-Helpers. The befuddled family welcomes this assistance. By now its members know they can pick neither the right stocks nor the right stock pickers. Why, one might ask, should they expect success in picking the right consultant ? But this question does not occur to the Gotrocks, and the consultant-Helpers certainly don't suggest it to them.

The Gotrocks, now supporting three classes of expensive Helpers, find that their results get worse, and they sink into despair. But just as hope seems lost, a fourth group - we'll call them the hyper-Helpers - appears. These friendly folk explain to the Gotrocks that their unsatisfactory results are occuring because the existing Helpers - brokers, managers, consultants - are not sufficiently motivated and are simply going through motions. "What," the new Helpers ask, "can you expect from such a bunch of zombies?"

The new arrivals offer a breathteakingly simple solution: Pay more money. Brimming with self-confidence, the hyper-Helpers assert that huge contingent payments - in addition to stiff fixed fees - are what each family member must fork over in order to really outmaneuver his relatives.

The more observant members of the family see that some of the hyper-Helpers are really just manager-Helpers wearing new uniforms, bearing swen-on sexy names like HEDGE FUND or PRIVATE EQUITY. The new Helpers, however, assure the Gotrocks that this change of clothing is all-important, bestowing on its wearers magical powers similar to those acquired by mild-mannered Clark Kent when he changed into his Superman costume. Calmed by this explanation, the family decides to pay up.

And that's where we are today: A record portion of the earnings that would go in their entirety to owners - if they all just stayedd in their rocking chairs - is now going to a swelling army of Helpers. Particularly expensive is the recent pandemic (epidemic) of profit arrangements under which Helpers receive large portions of the winnings when they are smart or lucky, and leave family members with all of the losses - and large fixed fees to boot - when the Helpers are dumb or unlucky (or occassionally crooked).

A sufficient number of arrangements like this - heads, the Helper takes much of the winnings: tails, the Gotrocks lose and pay dearly for the privilege of doing so - may take it more accurate to call the family the Hadrocks. Today, in fact, the family's frictional costs of all sorts may well amount to 20% of the earnings of American business. In other words, the burden of paying Helpers may cause American equity investors, overall, to earn only 80% or so of what would earn if they just sat still and listened to no one.

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of a genius. But Sir Isaac's talents didn't extend to investing: He lost a bundle in the South Sea Bubble, explaining later, "I can calculate the movement of stars, but not the madness of men." If he had not been traumatised by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

You can download the "annual letter to shareholders for 2005" from here -

http://www.berkshirehathaway.com/letters/2005ltr.pdf

Berkshire hathaway's marathon run continues...

Berkshire Hathaway has been an investor's dream over the last four decades. During 1965-2005, it yielded a return of 21.5 per annum. This essentially means that an investment of Rs.10,000 in Berkshire Hathaway in 1965 would've turned into Rs.1.99 crore by the end of 2005. Now thats a "mount everest" of a record, which few can think of achieving, let alone doing it. It is my goal in life to better this record, whether I do it or not, we will know in a few years from now. But, I will surely try.

Coming back to the company.

The performance of the company is surely great, if seen over the 40 year period. But, if one looks at the performance over the last seven years, it aint that impressive. Annual gain - 6.6 per cent per annum. Ofcourse, when compared with the performance of the S&P 500, it surely is a good one. But, nevertheless, by its own standards, Berkshire's recent performance seems lacklustre. Is this the end of Berkshire's marathon run of the last four decades ? I dont know.

Maybe after currencies, Warren Buffet needs to look at emerging markets, India specifically. However, I do not know how many companies in India will qualify for Warren Buffet to make an investment ? A few names that come to my mind are - Gas Authority of India (an all-India pipeline network, a virtual monopoly in gas transportation, a definitive moat), Maruti Udyog, Hero Honda, Raymond, State Bank of India, and Larsen & Toubro.

But, one thing is sure Warren Buffet is and will remain the best investor of all times !!

A few snippets from this year's annual letter to the shareholders -

1). When growth rates are under discussion, it will pay you to be suspicious as to why the beginning and terminal years have been selected. If either year was aberrational, any calculation of growth will be distorted. In particular, a base year in which earnings were poor can produce a breathtaking, but meaningless, growth rate.

2). On derivatives contracts (of a term as long as 100 years) - Its difficult to imagine what "need" such a contract could fulfill except, perhaps, the need of a compensation-conscious trader to have a long-dated contract on his books. Long contracts, or alternatively those with multiple variables, are the most difficult to mark-to-market (the standard procedure used in accounting for derivatives) and provide the most opportunity for "imagination" when traders are estimating their value. Small wonders that traders promote them.

3). When a problem exists, whether in personnel or in business operations, the time to act is "now".

4). Companies always, ofcourse, hope to earn more money in the short-term. But when short-term and long-term conflict, widening the moat (an advantage that cannot be easily reproduced) must take precedence. If a mgmt makes bad decisions in order to hit short-term earnings targets, and consequently gets behind the eight-ball in terms of costs, customer satisfaction or brand strength, no amount of subsequent brilliance will overcome the damage that has been inflicted. Take a look at the dilemmas of managers in the auto and airline industries (in US ofcourse) today as they struggle with huge problems handed them by their predecessors. Charlie is fond of quoting Ben Franklin's "An ounce of prevention is worth a pound of cure". But sometimes no amount of cure will overcome the mistakes of the past.

5). The underlying factors affecting the US current deficit continue to worsen, and no letup is in sight. Not only did our trade deficit - the largest and most familiar item in the current account - hit an all-time high in 2005, but we also can expect a second item - the balance of investment income - to soon turn negative. As foreigners increase their ownership of US assets (or of claims against us) relative to US investments abroad, these investors will begin earning more on their holdings than we do on ours. Finally, the third component of the current account, unilateral transfers, is always negative.

The US is extraordinarily rich and will get richer. As a result, the huge imbalances in its current account may continue for a long time without their having noticeable deleterious (harmful) effects on the US economy or on markets. I doubt, however, that the situation will forever remain benign. Either Americans address the problem soon in a way we select, or at some point the problem will likely address us up in an unpleasant way of its own.

Coming back to the company.

The performance of the company is surely great, if seen over the 40 year period. But, if one looks at the performance over the last seven years, it aint that impressive. Annual gain - 6.6 per cent per annum. Ofcourse, when compared with the performance of the S&P 500, it surely is a good one. But, nevertheless, by its own standards, Berkshire's recent performance seems lacklustre. Is this the end of Berkshire's marathon run of the last four decades ? I dont know.

Maybe after currencies, Warren Buffet needs to look at emerging markets, India specifically. However, I do not know how many companies in India will qualify for Warren Buffet to make an investment ? A few names that come to my mind are - Gas Authority of India (an all-India pipeline network, a virtual monopoly in gas transportation, a definitive moat), Maruti Udyog, Hero Honda, Raymond, State Bank of India, and Larsen & Toubro.

But, one thing is sure Warren Buffet is and will remain the best investor of all times !!

A few snippets from this year's annual letter to the shareholders -

1). When growth rates are under discussion, it will pay you to be suspicious as to why the beginning and terminal years have been selected. If either year was aberrational, any calculation of growth will be distorted. In particular, a base year in which earnings were poor can produce a breathtaking, but meaningless, growth rate.

2). On derivatives contracts (of a term as long as 100 years) - Its difficult to imagine what "need" such a contract could fulfill except, perhaps, the need of a compensation-conscious trader to have a long-dated contract on his books. Long contracts, or alternatively those with multiple variables, are the most difficult to mark-to-market (the standard procedure used in accounting for derivatives) and provide the most opportunity for "imagination" when traders are estimating their value. Small wonders that traders promote them.

3). When a problem exists, whether in personnel or in business operations, the time to act is "now".

4). Companies always, ofcourse, hope to earn more money in the short-term. But when short-term and long-term conflict, widening the moat (an advantage that cannot be easily reproduced) must take precedence. If a mgmt makes bad decisions in order to hit short-term earnings targets, and consequently gets behind the eight-ball in terms of costs, customer satisfaction or brand strength, no amount of subsequent brilliance will overcome the damage that has been inflicted. Take a look at the dilemmas of managers in the auto and airline industries (in US ofcourse) today as they struggle with huge problems handed them by their predecessors. Charlie is fond of quoting Ben Franklin's "An ounce of prevention is worth a pound of cure". But sometimes no amount of cure will overcome the mistakes of the past.

5). The underlying factors affecting the US current deficit continue to worsen, and no letup is in sight. Not only did our trade deficit - the largest and most familiar item in the current account - hit an all-time high in 2005, but we also can expect a second item - the balance of investment income - to soon turn negative. As foreigners increase their ownership of US assets (or of claims against us) relative to US investments abroad, these investors will begin earning more on their holdings than we do on ours. Finally, the third component of the current account, unilateral transfers, is always negative.

The US is extraordinarily rich and will get richer. As a result, the huge imbalances in its current account may continue for a long time without their having noticeable deleterious (harmful) effects on the US economy or on markets. I doubt, however, that the situation will forever remain benign. Either Americans address the problem soon in a way we select, or at some point the problem will likely address us up in an unpleasant way of its own.

Monday, March 06, 2006

Mittal Steel v/s Arcelor; Hypocrits shown the mirror

Sucheta Dalal wrote a brilliant article on the hypocrisy surrounding the hostile bid by Lakshmi Mittal to acquire European steel giant, Arcelor. It appeared in today's edition of Indian Express.

Some of questions raised by Sucheta are really worth pondering over. A small excerpt -

This is all very well. But now that we have waved our national flags and supported Lakshmi Mittal, can we apply our minds to whether the government will behave differently if and when a foreign company makes a hostile bid for any of our Indian bluechips?

Here is a list of some of the Nifty companies where promoters hold less than 30 per cent stake -

1). Tata Steel - 26.7 %

2). Tata Tea - 28.6 %

3). Tata Chemicals - 28.6 %

4). Satyam Comp. - 14.1 %

5). Infosys Tech - 19.6 %

6). Dr.Reddy's - 27.4 %

7). M&M - 23.6 %

and the list goes on....

So the question is -- Are we going to let foreign companies make "successful" hostile bids for these blue-chips ?

Some of questions raised by Sucheta are really worth pondering over. A small excerpt -

This is all very well. But now that we have waved our national flags and supported Lakshmi Mittal, can we apply our minds to whether the government will behave differently if and when a foreign company makes a hostile bid for any of our Indian bluechips?

Here is a list of some of the Nifty companies where promoters hold less than 30 per cent stake -

1). Tata Steel - 26.7 %

2). Tata Tea - 28.6 %

3). Tata Chemicals - 28.6 %

4). Satyam Comp. - 14.1 %

5). Infosys Tech - 19.6 %

6). Dr.Reddy's - 27.4 %

7). M&M - 23.6 %

and the list goes on....

So the question is -- Are we going to let foreign companies make "successful" hostile bids for these blue-chips ?

Thursday, March 02, 2006

Learning R, still bearish on markets and Warren Buffet's annual letter coming up

Its been a while since I posted anything on my blog. Blame it on 'R'. Have been trying to learn this statistical package, and the quest is still on. It is an extremely intelligent, but a programming language driven software which requires good amount of time and patience. Nevertheless, inspired by one of my mentors, I do intend to learn it well.

Infested by FII money, the markets seem to be scaling new highs virtually every day. Looking at the past few years data (relying a little on history), the ever expanding p/e ratios of index stocks, the sustained firmness in crude oil prices, slowing down in corporate profits and a slowdown in the overall Index of Industrial Production, I've been expecting a sharper correction in recent months. But, that seems not to be. Nevertheless, I remain concerned and am sitting on 50 per cent cash in the small portfolio that I currently manage. Haven't been able to find any new value buys (finding them in the current scenario seems like trying to find water in a desert, that too in the month of April). My main investment ideas, however, continue to remain so.

Warren Buffet's famous 'annual letter to the shareholders' for the financial year 2005 will be released on 4th March 2006. This is one thing no student of finance/stock markets should miss out on. It provides a great insight into the art of investing and teaches a lot more than many (rather most) of the finance books available today. The way Warren Buffet and his partnet Charlie Munger present the annual report is simply amazing. It is the pinnacle of good corporate governance practices and quality disclosures to the shareholders. A must read.

Infested by FII money, the markets seem to be scaling new highs virtually every day. Looking at the past few years data (relying a little on history), the ever expanding p/e ratios of index stocks, the sustained firmness in crude oil prices, slowing down in corporate profits and a slowdown in the overall Index of Industrial Production, I've been expecting a sharper correction in recent months. But, that seems not to be. Nevertheless, I remain concerned and am sitting on 50 per cent cash in the small portfolio that I currently manage. Haven't been able to find any new value buys (finding them in the current scenario seems like trying to find water in a desert, that too in the month of April). My main investment ideas, however, continue to remain so.

Warren Buffet's famous 'annual letter to the shareholders' for the financial year 2005 will be released on 4th March 2006. This is one thing no student of finance/stock markets should miss out on. It provides a great insight into the art of investing and teaches a lot more than many (rather most) of the finance books available today. The way Warren Buffet and his partnet Charlie Munger present the annual report is simply amazing. It is the pinnacle of good corporate governance practices and quality disclosures to the shareholders. A must read.

Subscribe to:

Posts (Atom)